Welcome Back, Future Funder!

5 minutes is how long it takes to cook some eggs, read a newsletter, or stuff your face with an entire bag of chips.

But did you know that it’s also long enough to change your financial future?

As parents, you might not feel like you have time to make huge habit changes in your finances. You’re either working full time (or more) and then parenting at home, or you’re a full time parent (who doesn’t get to go to the office as a break!). You don’t have time to make money-saving or wealth-building changes, right?

Well, we’re going to challenge you on that today with 4 quick money habits that take 5 minutes or less each day.

In today’s edition, you’ll learn how to:

✅ Automate the good things

✅ Eliminate the bad things

✅ Make a (quick) budget

Bon appétit! 🧑🍳

Presented by our partner Pacaso

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Please support our partners!

🍽️ Main Course: Getting Ahead Is Never Easy, but You Can Make it Faster

Social media makes constant promises of ways to get ahead quickly, ways to break the financial rules to beat out the rest, and plays you can make to hack the system.

If you’re reading this newsletter now, hopefully you know that most of those tactics are snake oil, and the other ones are just sound advice wrapped in hype-based packaging.

The tips we’re offering today are more in that second camp. You can’t cheat your way to financial health and wealth building, but you can certainly make it faster through best practices.

So without further ado, here are 4 ways you can save more money in 5 minutes or less a day.

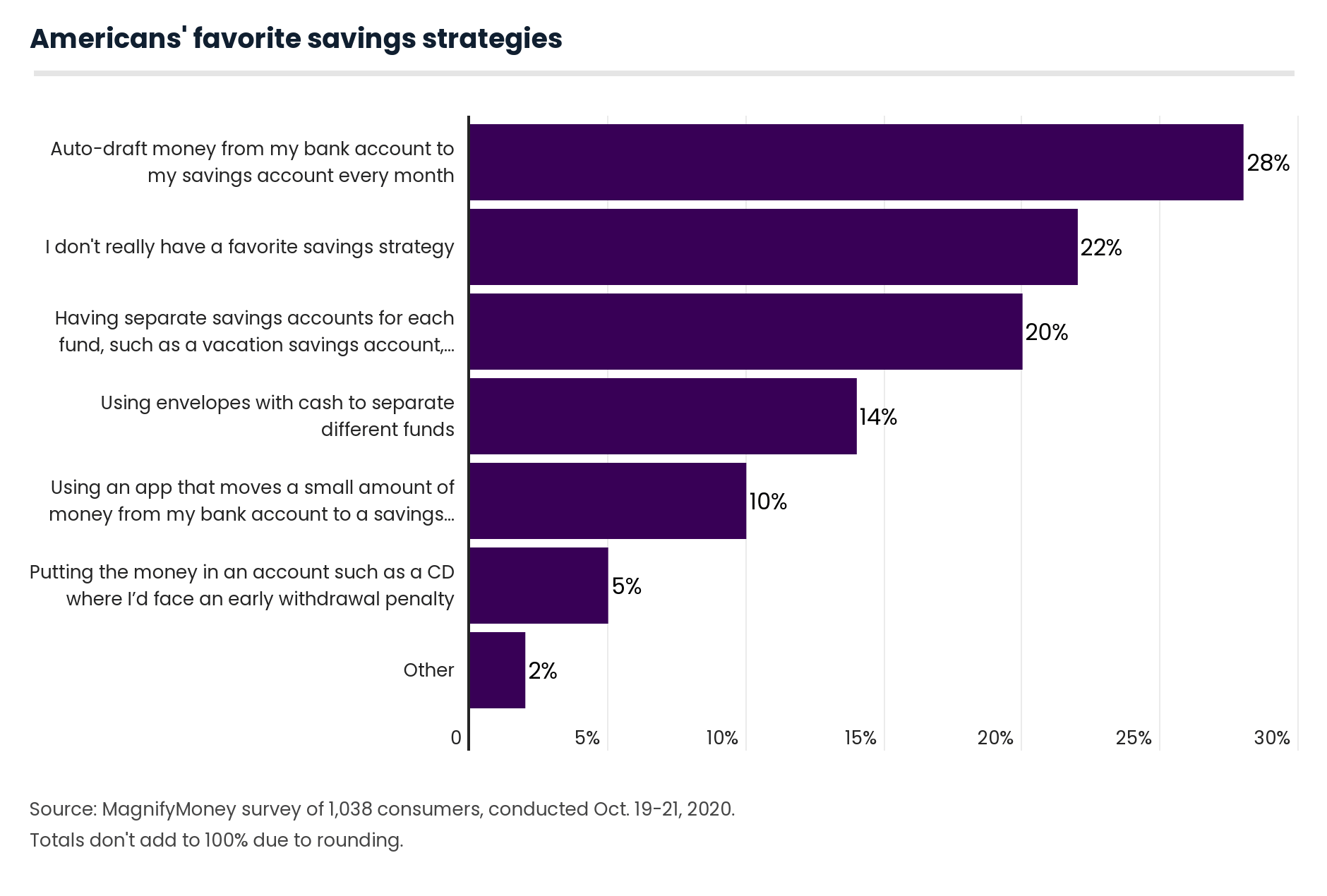

1. Set Up Automatic Transfers for Bill Payments and Savings

This one’s super easy. After you set it up, it actually takes zero minutes a day, since it happens automatically.

Take 5 minutes today to go through your bank accounts and set up an automatic transfer to a savings account each time you get paid. A common amount to save is 20% of your income (see tip #3 for a simple budget outline).

If you made $5,000 a month in income, you’d save up $12,000 a year at that percentage. And you wouldn’t even have to think about it. Factor in compounding interest, and you’re off to the races.

Source: Magnify Money

The next day, you can go into your utility account and set up automatic bill payment with your debit card (you may have this done already; hats off if so).

Do the same with your rent, wi-fi bill, phone bill, and anything else if possible. The more you can automate, the less time you’ll spend on it in the future.

Tip: You can set your tax refund money to be automatically transferred to your savings account before you receive it.

Just set up a one-time transfer of the refund amount as soon as you know what the refund will be (but before it hits your account. That way, Instead of “treating yourself” today, pay your future self instead!

2. Use Investing Apps That Round Up Purchases for You

What if you could invest a bit of change at a time every time you made a purchase on your debit card? That’s what Acorns does. It’s an app on your phone that literally just invests the spare change left in a purchase you made.

Made a purchase of $4.55 for a coffee? $0.45 just went into your investing account. And you didn’t have to make the payment. And it was only $0.45, right? Nothing like the difficulty of sending $1,000 to an investing account.

But those bits of change add up over time. And they get put into ETFs, which are bundles of investments you can buy on the stock market (less risky) instead of single stocks (more risky).

Image: Acorns, Yahoo Finance

And you can set up recurring weekly investments to go into your acorn account automatically in addition to your “Round-Ups.”

Imagine your Round-Ups add up to $100 a month in investments. Then you add in $50 a week, so another $200 a month. That’s $300 a month, or $75 a week. Now factor in an example growth rate of 7% over 10 years.

$56,576. For real. If you invested $75 a week through Acorns and got a 7% return over 10 years, you’d have $56,576 in just 10 years. (Returns not guaranteed, just hypothetical)

And this is all automated. You don’t have to think about it at all—just take 5 minutes today to set up your account.

Tip: If you put ~$500 into your Acorns account at the very start, at a hypothetical 7% interest rate, you’ll break even on the $36/year account fee. Then everything else you invest will be gravy on top.

Also, this isn’t sponsored content, we just think that this app could be useful for you. You can download Acorns here:

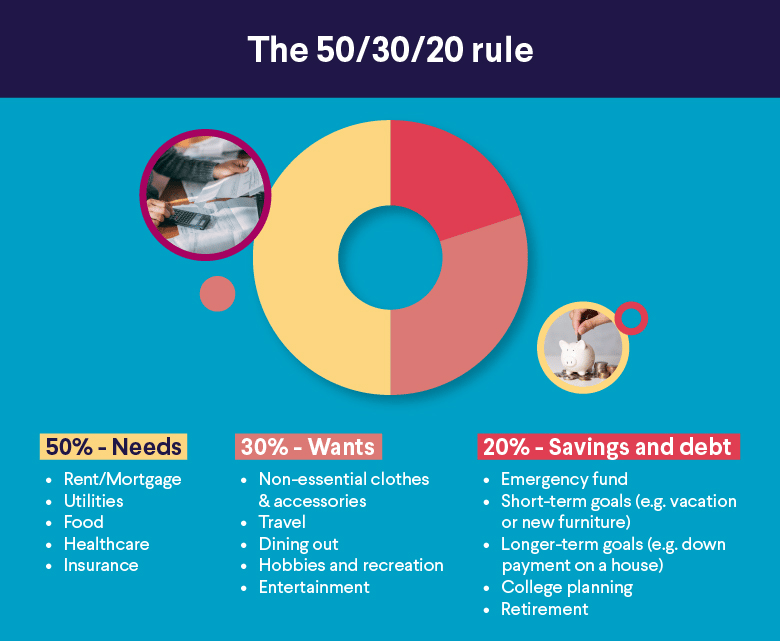

3. Make a 50-30-20 Budget

86% of people have a budget. 84% of those people say that budgeting has helped them avoid debt (or pay it off). If that’s not reason enough to spend 5 minutes on a spending plan, we don’t know what is!

Don’t have time for the insanity of a spreadsheet budget that uses 4 different tabs and hundreds of cells at once? Just keep it simple. Simple is good. Simple works.

Although a “50-30-20” budget might sound complex, it’s hard to make a budget more simple than this one. All the title means is that 50% of your budget goes to expenses, 30% to “wants,” and 20% to savings.

Image: SoFi

This doesn’t have to be a complex process. Just sit down, set a timer for 5 minutes, and write down every expense in each of the three categories above as fast as you can. Congrats, you have a budget!

Then just follow that plan and stay within budget, and you’re golden. Just having something on paper to reference for your spending is half the battle.

And if you realize that you forgot to write one of them down, just go back and add it later. Simple as that. No need for perfectionism here. Don’t let fear of messing up stop you from taking action.

41% of people feel that making a spending plan (and following it) has improved their relationship with money more than anything else. Translation: it is worth it to start a budget.

Tip: Scroll through your bank app transaction history to find all the recurring bills you might miss otherwise (Spotify, Amazon Prime, etc.).

4. Get Rid of All Banking and Finance Fees

ATM withdrawal fees. Overdraft fees. Paper statement charges. Convenience fees. “Expedited payment” fees.

All of these are costing you real money, and none of them are necessary. Some of them might be convenient, sure, but none are necessary.

The average out-of-network ATM fee was $4.77 in 2024. Pay that twice a month, and you’re losing $114.48 each year.

Bank overdraft fees are often $30. If you accidentally overdraft just 3 times a year, that’s $90 annually.

Paper statement fees might be $5 a month, or $60 a year.

All of a sudden, you’re paying a total of $264.48 a year in fees that are… completely avoidable. And that’s not even factoring convenience or expedited payment fees.

You can save a serious chunk of change each year by eliminating these costs. Each of these fees has a particular solution, so you can follow the list below to arrive at the answer you need.

ATM withdrawal fees → Only use ATMs in your bank’s network so withdrawals are free. If your bank doesn’t have those, switch to a new bank with a better ATM network.

Overdraft fees → Set up a low balance alert notification for your bank account. Or get a bank account with no overdraft fees (we’d recommend not overdrafting in the first place though).

Paper statement charges → Go into your bank account settings and switch to digital statements only.

Convenience fees → Stop using your credit card in places that charge you extra for it. Only use credit cards when it will not cost you any extra.

Expedited payment fees → Plan further ahead with finances so you can choose the 2-3 day free delivery on Venmo and Paypal cashouts instead of the instant option that takes a (sizable) fee.

You might be able to knock out multiple of these in one sitting, but you can also just break them up into individual 5 minute tasks over the course of a week.

Tip: Building an emergency fund as a financial cushion can help you eliminate the need for hasty ATM withdrawals, accidental overdraft fees, and expedited payment fees too.

Bottom Line

You are very busy as a parent, and you do not have hours to devote to your finances. That’s why it’s important to find the smart money habits you can form (or automate) that will give you the most bang for your buck.

The best part is that you can teach each one of these to your children and set them up for success, too.

Cheers to getting 1% better each week! 🥂

👂 We’d love to hear from you

What did you think of today's email?

👂 What smart money habits have you already implemented?

We’d love to hear about it—and your story could help someone else do the same.

Just hit reply and share.

Thanks for reading,

—Your friends @ Future Funders 🍽️

P.S. Forward this to a friend who’s insanely busy but could use a little financial boost! 😁