People talk about finance and investing like you have to find THE right answer.

"Don't miss out on this silver bullet opportunity!"

"DO NOT miss this investment or you'll lose out big time!"

Here's the truth: There are thousands of stocks, bonds, ETFs, and savings accounts you could choose from. If it feels impossible to know which one is the "right" option... that's because there is no single right option.

But here's what shocked us when we actually ran the numbers: The average American has $65,000 in their savings account earning 4% interest. After 30 years at 4%, that becomes $211,000. Not bad, right?

Except if they'd put that same $65,000 in an S&P 500 index fund earning the historical average of 11%, it would become $1.5 million. That's $1.3 million in lost wealth from choosing "safe" over "growth."

The difference isn't finding the perfect stock or timing the market perfectly. It's simply beating inflation consistently over decades.

And today, we're walking you through how to do exactly that: beat inflation.

In this edition of Dinner Table Discussions:

✅ Why beating inflation (not finding "the one perfect investment") is the real goal

✅ The investments that lose to inflation (and the ones that beat it)

✅ How much risk you need to accept for real wealth building

Bon appétit! 🧑🍳

In partnership with Brownstone Research

|

Are we in an AI bubble?

Should you take action quickly, before we see a crash?

The time has come for answers to these serious questions.

That's why we just flew in the foremost expert on AI.

Please support our partners!

🍽️ Main Course: How to Beat Inflation in 2026

You’ve likely heard a lot of “advice” on what to do to grow your wealth over time, from “Just trust me bro buy this crypto” to “Stick your money in a savings account and never touch it!”

While there are many paths to defeating inflation, the more important question is what not to invest in.

We’re talking about investments that either lose to inflation or just match it.

Disclaimer: we don’t think any of these options are bad; they’re great places to park some of your money to get consistent returns. We just think there are better ways to actually build wealth with the bulk of your money.

Also NOTE: Inflation has been around 2.6% per year on average for the past 20 years. So even if 4% interest in your bank account sounds good, it’s really only 1.4% growth on average once you factor in inflation! Not much at all.

Anyway, here are the options that don’t really beat inflation:

High-yield savings accounts: Even at around 4% yield at best, these savings accounts will only help you match inflation or just barely beat it. And that’s not enough to secure future wealth.

Government bonds: Similar story here; you won’t get rates higher than a high-yield savings account here unless you want to park your money in a 10-30 year bond and get… 4.09 to 4.70%.

Money market funds: This is the high-yield savings account of brokerages. You’ll get exposure to a mix of government bonds, which will earn you (you guessed it) around 4%.

Low-yield dividend stocks: Here, we’re talking about any dividend stock or dividend ETF (a fund made up of multiple dividend stocks) that pays a 4% or lower yield.

All of those options are just too slow for building wealth. They’ll keep your head above water, sure, but they probably don’t have the juice to land you in an wealthy position by the time you retire.

The Investments That DO Beat Inflation (On Average)

Alright, with the low-yield options out of the way, here’s a list of every type of asset that can help you outgrow inflation.

What you need to remember here is that growth = risk. In order to get access to higher growth potential, you have to accept higher amounts of risk. That’s why we look at “average” returns over decades for these types of investments, because one year could be +36%, while the next is -12%. Long-term positive returns are the goal.

So, without further ado, number one:

1. Growth-Focused ETFs

ETF stands for “exchange-traded fund.” These are stocks you can buy that are made up of other stocks. That’s useful because it allows you to diversify your portfolio with just one investment. For example, the S&P 500 is an index fund that gives you exposure to 500 of the largest companies in the USA.

ETFs are great because you can still set them and forget them just like the low-yield options above, but they generally grow more than those 4% yield options on average.

We highlighted “growth-focused ETFs” specifically because there are many ETFs out there that only average a 1-3% growth rate. If we’re trying to build wealth for the long term, that’s not the kind of ETF we want to focus on.

ETF average yearly performance over the past 20 years

S&P 500: 11% per year

Dow Jones: 10.5% per year

Russell 3000: 8.1% per year

2. Individual Stocks (Presented by AltIndex)

If ETFs are a step up in risk from a savings account, buying individual stocks is a leap in risk. Here, you aren’t tying the fate of your dollars to the performance of hundreds of companies; you’re tying it to just one company at a time. Which is why if you’re investing in individual stocks, it’s super important to 1) do your own research and 2) still diversify your portfolio with multiple stocks or even some ETFs.

A key point here is that it’s good to monitor the health of the stocks in your portfolio. We don’t mean “watch the price all day.” We mean you need to watch the financials and health of the companies you invest in to see if the reasons bought their stocks in the first place still stand.

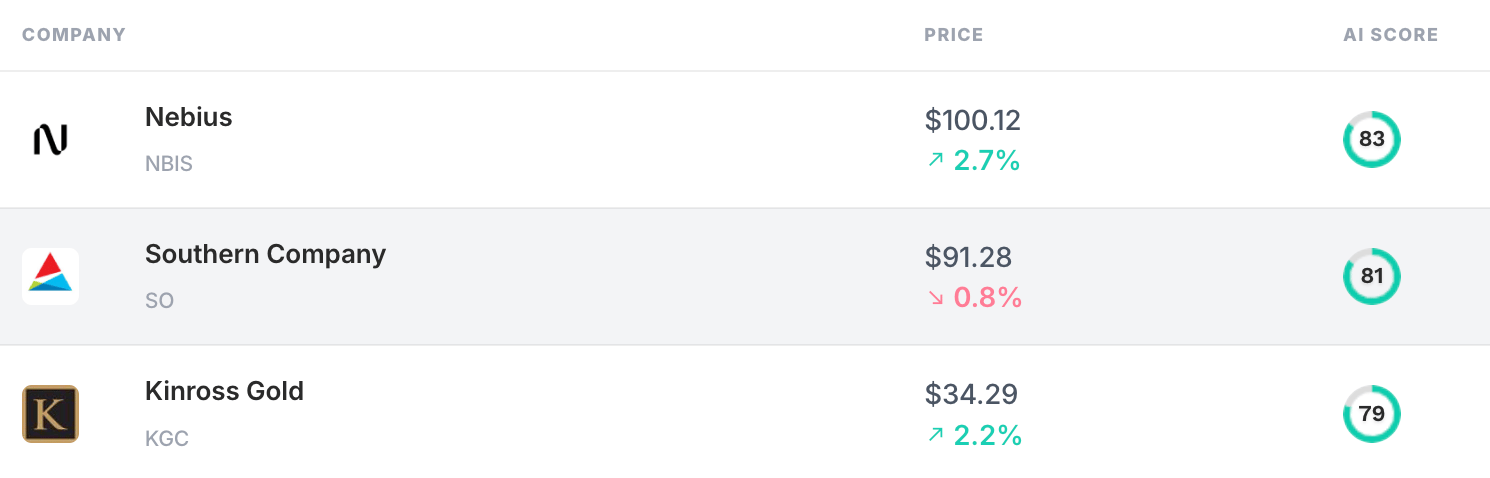

AltIndex has a dynamically updated stock rating system that factors in not just company financials, but also social media sentiment, hiring data from Linkedin, and internal employee sentiment.

Here are the current top 3 stocks on AltIndex:

Please support our partners!

3. Private Companies

Now this category is an even bigger step up in volatility than single stocks.

Private equity, or investing in private companies, is where you buy shares in businesses that aren’t publicly traded on the stock market. This is the kind of investing that venture capital funds and angel investors do. Like all the people who invested in Facebook before the company went public in 2012. Peter Thiel made over $1B from his initial $500,000!

Now, there’s a way for normal people like you and us to get access to these markets, but more on that in a second.

Traditionally, you could only invest in private companies if you qualified as an “accredited investor,” meaning that you either had a net worth of $1M (not including your primary home) or had an income of $200,000 if single, or $300,000 if married.

Those are steep requirements, but two large reasons for them are how volatile private equity is and how expensive it is. The majority of private companies fail, and the minimum investment amount is usually $250,000.

But get this: Robinhood is launching a private equity fund that normal people like you and us can invest in. It’s going to go public in a matter of weeks, and you can buy shares in its IPO (initial public offering) now on the Robinhood app if you want! You should know, though, that the companies in this fund aren’t brand new like Facebook was when Peter Thiel invested; these are companies that are already valued at over a billion dollars, so the upside likely won’t be as big. Still, an intriguing opportunity!

Be advised that private equity is a highly volatile industry, and that this is not investment advice. This is also not an advertisement for Robinhood. Do your own research. Past performance does not guarantee future results.

Bottom Line

There are so many ways to invest, but you can narrow your choices down by honing in on your desired outcome. If the goal is to beat inflation, you simply need to focus on investments that historically beat inflation! From there, it’s all about how risky you want to be, how much time you want to leave your money in the market, and how much wealth you want to try and build.

Cheers to getting 1% better each week! 🥂

👂 We’d love to hear from you

What did you think of today's email?

👂 Are your investments beating inflation? What's your strategy?

We'd love to hear about it—and your approach could help someone else think through their own investment choices.

Just hit reply and share.

Thanks for reading,

—Your friends @ Future Funders 🍽️

P.S. Forward this to a friend who's keeping too much money in their savings account. Show them what they could be leaving on the table! 💰

The information provided in Dinner Table Discussions is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Dinner Table Discussions is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance doesn’t guarantee future results.

Future Funders, Dinner Table Discussions, AltIndex by Invested Inc. (AltIndex LLC), Stocks & Income, Finance Wrapped, and The Chain are all owned by Invested Inc.