Welcome Back, Future Funder!

So, if you haven’t yet… It might be time to rethink your relationship with your phone.

Not because it’s decreasing your attention span or taking away from family time (though it might be).

It’s because studies show that smartphones influence people to make shortsighted financial decisions.

In other words, your iPhone might be the final boss in the way of your financial goals!

In today’s issue we look at:

✅ Key (Painful) Findings in Smartphone Money Psychology Research

✅ The Apps That Might Be Causing You to Lose $$$ On Your Phone

✅ How to Stop Making Bad Financial Decisions (Solutions + Ideas)

Bon appétit! 🧑🍳

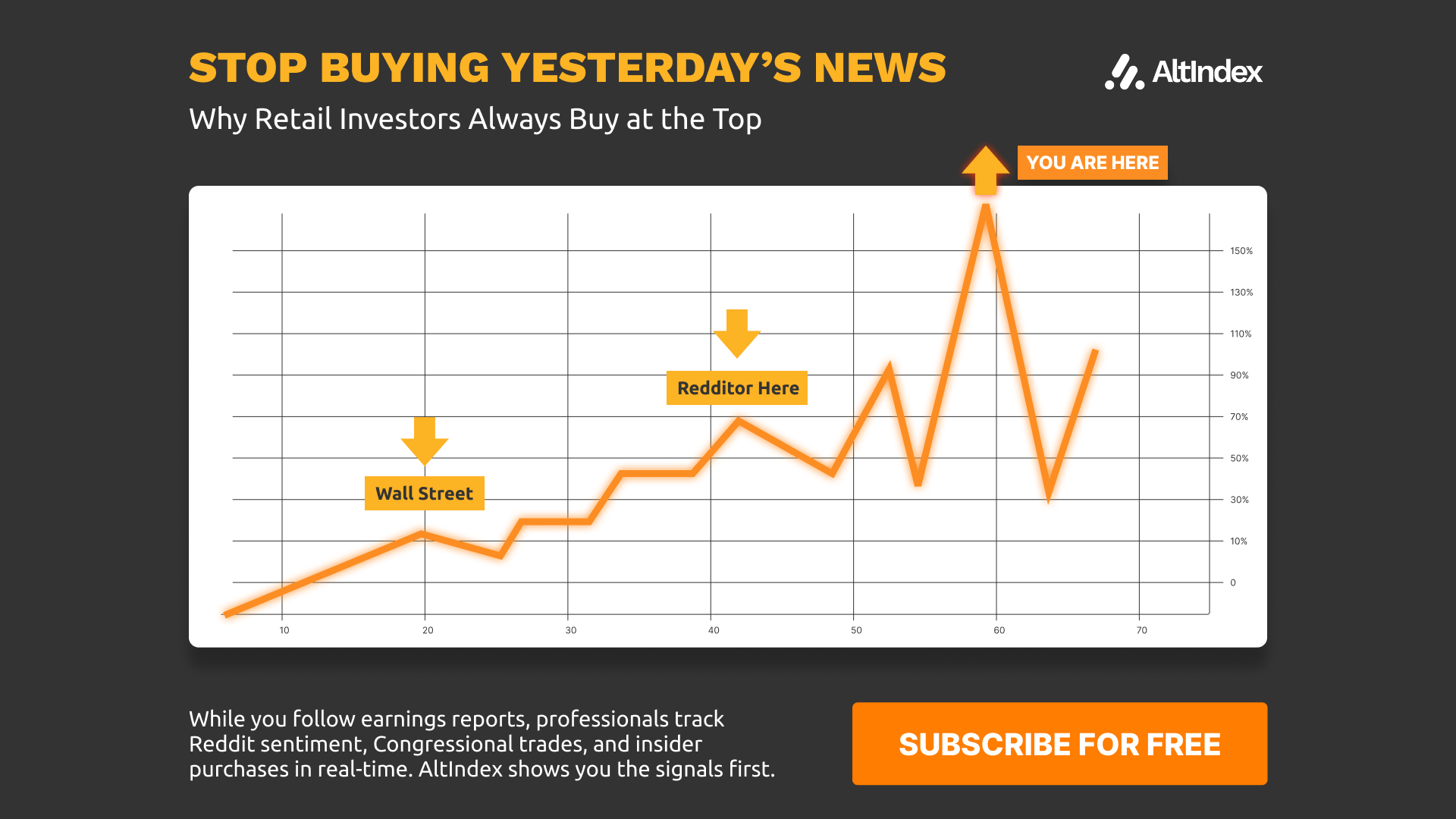

Presented by our partner AltIndex

8 Out of 10 Analysts Missed This 469% Winner

Before $OPEN rose 469%, three key stock signals appeared:

July 15: Reddit mentions of OPEN spike 12,400%

July 5-25: Opendoor’s job postings surge 816%

August 7: Congressman Cleo Fields buys shares

Meanwhile, only two out of 10 Wall Street analysts gave OPEN a buy rating.

If you followed the analysts, you missed a 469% gain. If you tracked the alternative signals, you were positioned before the surge.

Markets don't price fundamentals anymore. They price behavior.

Crowd psychology, social sentiment, and insider moves now matter more than P/E ratios. The institutions figured this out years ago. Retail traders are still using yesterday's playbook.

AltIndex tracks Reddit sentiment, Congress trades, hiring trends, and insider activity in real-time. Get alerts when signals spike—before the crowd catches on.

Stop analyzing companies. Start analyzing behavior.

Please support our partners!

🍽️ Main Course: How Studies Say Your Phone Hurts Your Wallet

So you already know you’re supposed to bring your screen time down and that Clash of Clans probably isn’t the best way to spend all your free time if you want to retire wealthy.

But did you know that your phone might be influencing you to do the following?

Opting for instant but smaller financial rewards

Saving less for retirement than people on laptops or tablets

Having a bias toward recent information in financial decision making

Overall, Wang et al. (2023) found that “financial decisions made on smartphones (vs. laptops or tablets) are more likely to be shortsighted” and lead to the above three results.

Do you understand what this means?

Like, I know you understand the meaning of the words, but do you feel the weight of them?

Making financial decisions on your phone might be 1) keeping you from retiring earlier, 2) stopping you from becoming wealthier, or 3) just influencing you to make financial decisions based on recent news versus historical data.

I don’t know about you, but that sets some alarm bells off in my head.

“Ok,” you say. “Well what do you mean by ‘financial decisions on your smart phone’?”

I am so glad you asked. Let me explain.

Laundry List of Phone-Based Financial Decisions

We’ve covered the effects that financial decision-making on your phone can have, but what are some actual examples of decisions people are making on their iPhones?

It can’t be that bad, right?

Well, it’s not that it’s TERRIBLE, it’s just that these things can hurt your financial goals in the long run:

Using brokerage apps like Robinhood

If you manage your investment accounts on a brokerage app like Robinhood or WeBull from your phone, I highly recommend that you delete the app and only use the web-based version. Why?

Because I think those apps are designed to make you trade more frequently. The more trades you make as an amateur trader (which is what I am, too), the less likely you are to be profitable.

Translation: you should not try to make it big like a day trader. You know why? Because most day traders don’t make it big! You can totally make educated investments in stocks, but you don’t need to be spending time trading like this:

Example: if you bought Nvidia shares at the start of this year and just held them till now, you’d be up 28.91%. If you tried to buy and sell Nvidia every time the stock went up or down based on news, you likely would have lost a lot of money: according to a study in Brazil, about 97% day traders lost money over the course of 300 days (Investopedia).

Banking apps

This is in a similar vein to the brokerage apps.

If your banking app is on your phone, we’d also suggest deleting that and using the browser-based version on your laptop.

The reason is that today, you can get served an ad on Instagram for something you really want, then go to your banking app, transfer over $500 from your savings account to your checking, and then buy that thing you saw the ad for, all in about 15 seconds and from your phone…

…So yeah, it’s going to be really difficult to stick to your financial goals if you don’t place some guardrails around your finances.

Food delivery apps like DoorDash

“I only use DoorDash when they give me deals.”

“With the monthly membership I actually save money.”

“The convenience is worth it.”

Ok, maybe some of those reasons are legit in some cases… but overall, there’s never a reason to use DoorDash instead of going to the store, buying simple ingredients, and making a meal at home for way less money than DoorDash costs. Or at least driving to the restaurant yourself to pick up the food.

And yet, people continue to get food delivered for exorbitant prices. After factoring in taxes, delivery fees, and tip, you might pay $30 just for some tacos in some areas!

I think people use food delivery apps because in just a couple clicks, you can have whatever food you want. Instant gratification. It’s even faster than fast food; it’s “instant food.”

If you have any of these apps on your phone and you’re prone to using them, it might be worth considering getting rid of them.

ANYTHING with BNPL (Buy Now Pay Later)

I’m going to be honest.

I think that you should get far, far away from any app that allows you to use BNPL as a payment option.

It’s not helping you, it’s hurting you (even if it offers you a zero interest option).

You do not need to be entering into debt to pay for a new TV, some new AirPods, a new bike for your kid, or a Chipotle burrito.

BNPL encourages overspending, puts you in debt, and specifically targets “consumers who are most susceptible to borrowing when they shouldn’t,” according to CNBC.

Don’t be one of those consumers. If you need to buy something big, save up for it. If something is out of your budget, don’t buy it. If you’re in an emergency, that’s what an emergency fund is for!

I’m not compassionless, and I understand that life doesn’t go as planned sometimes. But I want to be clear that you can (and should) have a plan in place for financial decision making that enables you to avoid BNPL payment options altogether.

Solutions to Bad Financial Decision Making On Your Phone

Those were some of the pitfalls that I think can lead to short-sighted financial decisions on your phone. Now let’s talk about some great solutions that encourage long-term-oriented financial decisions.

Define Your Financial Goals

If you don’t know what your long-term goals are, then of course you’ll make short-sighted decisions. In order to make choices that are aligned with your vision for your family’s future, you need to have a vision in the first place!

What dreams do you have? Home ownership? Becoming debt-free? Retiring? Retiring early? Becoming a millionaire?

Then, after you decide on your big goal, translate that into the simplest recurring goal possible: a budget. After that, just watch how your decision making starts to change when you realize that your BNPL Chipotle burrito money could actually go toward making your family wealthy in the long term.

Don’t Make Any Financial Choices on Your Phone… Duh

You might be saying, “Well this is obvious.” But sometimes it’s helpful to just be told you have permission to do something countercultural.

Yes, you can get rid of every financially-enabled app on your phone (and remove your card from the app store) and just use your computer or tablet for them. For real. That means you could delete these apps from your iPhone entirely:

Robinhood

DoorDash

Uber Eats

Banking Apps

Apple Pay (just remove your card info)

Any games you compulsively spend money on

Amazon

Grocery apps

And again, you can still use your laptop or tablet for these things. The point is to remove them from the context of your dopamine rectangle—I mean, your smart phone. Try it out and tell us the results!

(Extreme) Get a Dumb Phone

Yes, I know, this one’s crazy and you have a million reasons for why you could never get rid of your iPhone or Android and getting a dumb phone seems awful. I get it.

But think about how good it could be for you.

If you take an honest look and discover that you do indeed make poor financial decisions on your smart phone, and it’s to the point where just deleting apps wouldn’t help…

Why not consider a more drastic change if it could help improve your financial health significantly?

Plus, I’m not talking about getting a Nokia flip phone from 2004. There are options like the Light Phone III now, which are stripped-back smart phones with only the most essential functions included.

Image: The Light Phone

Just make sure you don’t buy it with BNPL 😉

Bottom Line

Overall, it’s been shown through academic studies that humans make more short-sighted financial decisions on their phones than they do on laptops and tablets.

If that’s you, it doesn’t make you a bad person. It just makes you human. It’s less about shame and more about “What am I going to do now that I know this?”

There are various different apps out there that are engineered to make you think in the short term. Food delivery, trading apps, and even micro-transactions in games are all screaming one thing at you: “BUY!”

You don’t have to listen to them, though! You could choose to make financial decisions from your computer, delete those apps, or ditch your smartphone altogether.

Whichever you choose (or don’t choose), know this: I’m just here to offer thoughts and information for your own decision making, not here to judge or to give financial advice.

Cheers to getting 1% better each week! 🥂

👂 We’d love to hear from you

What did you think of today's email?

👂 What apps have you deleted because you were spending too much on them?

We’d love to hear about it, and your story could help someone else do the same.

Just hit reply and share.

Thanks for reading,

—Your friends @ Future Funders 🍽️

P.S. Forward this to a friend who’s always ordering DoorDash but doesn’t have DoorDash money. 😁