Read time: under 4 minutes

Rise & Shine, Future Funder!

We've whipped up a fresh batch of financial flavor for your Dinner Table Discussions. New format, same money-savvy goodness! From RV dreams crashing into mortgage realities to fast food's incredible shrinking act, we're serving up some tasty insights this week. Like the new recipe? Spill the beans at the end. Let’s dive in.

On the menu today

RV adventures meet housing reality

Tutorial: Compare living costs in seconds

Fast food's shrinking city takeover

What in the heck is CPI?

Vibecessions, vouchers, and Costco's oops

SpongeBob's unexpected money wisdom 👀

FAMILY FORCAST

RV Life to Condo Living: A Housing Odyssey 🚐➡️🏠

Wake up and smell the opportunity! The Botani family's RV adventure during the pandemic took an unexpected turn when they decided to plant roots in the midst of a real estate whirlwind.

Mehmet and Tara Botani, a Kurdish couple, embraced nomadic living the past 2 years out of their RV, searching for their forever home - somewhere down the road.

Plot twist: Rising mortgage rates slashed their $550,000 pre-approval to $470,000. Ouch.

Their house hunt menu featured quite the spread: a double-decker duplex, a D.C.-adjacent condo, or a fresh-out-of-renovations house.

The winner? Northern Virginia, with its cultural buffet and opportunity smorgasbord – serving up the American dream.

Why It Matters: The Botanis' journey is a snapshot of the larger struggle families face in the quest for stability amidst economic turbulence. Skyrocketing mortgage rates and home prices are turning the cozy nest hunt into an extreme sport, putting long-term financial health and personal peace on shaky ground.

Bottom Line: House hunters, keep your finger on the pulse of mortgage rates and real estate trends – it's your secret weapon. Don't shy away from unconventional housing options or locations, and remember: community is key. Your perfect home should be a win-win for your wallet and your wellbeing.

Dinner Table Debate: If your family were house hunting in this high-stakes market, what would be your non-negotiables and deal-sweeteners?

TRY IT OUT - 30 SECOND TUTORIAL

Zip Code Showdown: Where's the Cheapest Banana? 🍌

Is your nest-flyer eyeing a pricey city? Is grandma grumbling about her local fruit stand markup? Time for a quick reality check, folks!

Here's your 30-second tutorial to try:

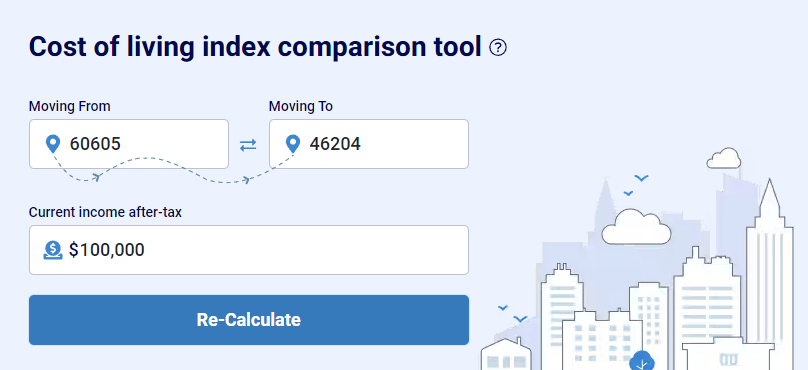

Head over to Insure.com's Cost of Living Calculator.

Enter your current location and potential new city.

Input your annual income and click "Re-Calculate".

Presto! You've unlocked your financial fortune-teller. If the results mirror our Chicago vs. Indianapolis comparison, Grandma might want to stay put in her fruit-friendly haven. Surprise, surprise - the Windy City isn't the bargain banana paradise you might expect.

Why not try it yourself? Your budget (and your produce drawer) might just breathe a sigh of relief. 🍌💰

DAD JOKE OF THE DAY

Prepare yourself… this ones a bit corny 🌽

“Why did the scarecrow become a successful banker?”

CHICKEN & TRENDS

The Takeout Takeover 🍽️

Source: NY Times

The fast-food industry is revamping its drive-thru approach—focusing on speedy service. Chains like Chick-fil-A are moving away from sit-down dining, opting for compact urban locations designed to serve busy city dwellers on the go.

This takeout-focused trend isn't just a lingering pandemic effect. It's a calculated move to capitalize on convenience for customers who prefer quick service over leisurely dining. The impact? Manhattan's retail spaces decreased by 17% from 2019 to 2023, with cafes and fast-food restaurants leading the downsizing trend—giving these streamlined locations prime positioning.

But for families and busy parents, does this shift bring benefits or challenges? While it might mean fewer meltdowns waiting for a table, it could also spell the end of family sit-down meals out. There's also the potential budget strain lurking behind the convenience. More frequent fast-food purchases might mean fewer home-cooked meals.

As urban areas transform their retail landscapes, families may need to adjust their routines—and budgets. Staying informed about these city trends can lead to smarter dining choices, balancing convenience with nutrition and financial goals. The takeout tsunami is coming; families, start your engines.

LEARN ANYTHING NEW?

Today's Lesson: What is CPI? 🤔

Source: Investopedia

(Pronounced: C-P-I or "Consumer Price Index")

📊 Picture this: CPI is like a financial thermometer for your family's wallet. It measures the temperature of prices for everyday items you buy, from groceries to haircuts.

The Consumer Price Index (CPI) tracks how much the cost of your family's typical shopping basket changes over time. It's calculated using a massive survey of 80,000 prices across the country each month. Why should parents care? Because CPI is the official yardstick for inflation, which directly impacts your household budget.

Real talk: When you hear "CPI rose 3.3% last year," it means your $100 grocery run now costs $103.30. This affects everything from your morning coffee to your kids' college savings. Here's how it hits home:

Your paycheck: Employers often use CPI for cost-of-living raises

Your bills: Rent and some utility rates may increase with CPI

Your benefits: Social Security and some pensions adjust based on CPI

Your taxes: IRS uses CPI to adjust tax brackets and deductions

Bottom Line: Keeping an eye on CPI trends can help you anticipate changes in your family's cost of living. It's not just a number—it's a tool for smarter financial planning. Whether you're budgeting for next month's expenses or planning long-term savings, understanding CPI gives you a clearer picture of your money's real value over time. So next time you hear "CPI" in the news, remember: it's talking about your wallet.

ALL THE FIXIN’S

3 Tools to Upgrade Your Budgeting

✅ RocketMoney: Tracks spending, sets budgets, and negotiates bills.

✅ Excel Budgeting Templates: Free spreadsheets for manual financial tracking and budgeting.

*indicates a promoted tool, if any

LET’S GO AROUND THE TABLE

Everything else you need to know today

Source: US News

The 'Vibecession.' A shift towards prioritizing well-being alongside financial stability. This trend, prominent among younger generations, may begin to reshape family dynamics and career outlooks for all ages.

Education Shake-up: A surge in public school voucher programs fuels growth of microschools, offering families alternative education options amidst ongoing debates.

Lawsuit Blues: Costco faces a class-action settlement over its tipping practices, requiring it to pay nearly $8 million to affected customers across multiple states.

Job Market Rollercoaster: The U.S. added a robust 209,000 jobs in June, defying expectations of a slowdown and raising concerns about persistent inflation.

😆 Brotherly Love: Someone in the family need help finding a spouse? Here’s some creative inspiration from a pair of brothers. These two rented a billboard and kicked off a TikTok campaign to find their elder sibling a wife. Talk about taking sibling support to new heights!

CREATIVE FINANCE - ART EDITION

SpongeBob becomes a financial advisor 🏦

🧙♀️ Your wish is our command

What did you think of today's email?

Thanks for reading.

Until next time!

The Future Funders Team 🍽️

p.s. If you liked this newsletter, share it with your friends and colleagues here.