Hey {{ First_Name | Future Funders family }},

Happy New Year!

A friendly reminder that you too can mold one of your kids into a college athlete so they can earn NIL money and pay for their sibling’s student loans (we ❤️ this video).

Okay let’s get to it…

💬 Quote Of The Week

“Every year you make a resolution to change yourself. This year, make a resolution to be yourself.”

- Unknown

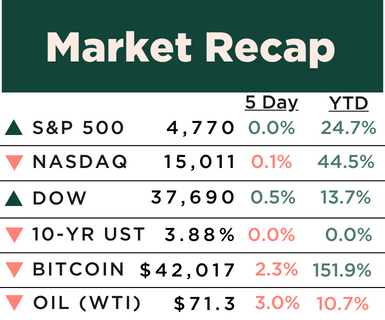

*Stock data as of 12/29 market close, bitcoin as of 4pm 12/29. Here is what these numbers mean.

🚀 What’s happening: Markets generally didn’t change much in the last week of 2023 with the S&P 500 now sitting near all time highs.

Oil also ended the year down and according to experts, gas prices in 2024 should average about $3.38 per gallon, falling further from 2023 at $3.51 per gallon (rule of thumb: roughly a $10 change in the price of oil per barrel equals about a 25 cents change per gallon in gas for families at the pump).

Where the market goes next (assuming no geopolitical escalations) will very much depend on if inflation continues to come down (allowing the Fed to lower interest rates) and if companies still sound mostly positive about the economy.

January will give investors a ton of data to help clear this picture up. Here is the near term data to keep your eye on:

The US Jobs Report for December (1/5). A bad report would be good (but not too bad). Sounds strange but if you see the report say the U.S. added slightly less than 170,000 new jobs in December, it would indicate the economy is continuing to slow down at a reasonable pace (which means inflation can also slow).

Potential SCOTUS decision on Colorado Trump ruling (likely before 1/5). We say this likely comes before 1/5 as that’s when Colorado ballots are printed. While the market tends to do well in an election year, the decision could have implications for overall election odds so it’s worth watching.

The US CPI for December (1/11). This is the next inflation report we get and the market will be looking for a continued slowdown.

The start of earnings season (1/11). Companies will start to report their earnings and talk to their outlooks for the year. The market will be extra sensitive around increased signs of economic weakness or inflation sticking around.

👪 Closer to home: Overall we remain positive on the market over the next 6-12 months (we stand by our prediction of the S&P reaching 5000 by the end of summer), but think given the recent run pointing to some serious optimism a pullback of ~1-3% would be healthy as the market watches and evaluates these data points that come in.

🍽️ Main Course

Your Money And Your Kids

Let’s Talk Taxes

🚀 What’s happening: Changes in the tax code are coming this year that are worth paying attention to (don’t worry we’ll keep it snappy):

Social Security is changing.

Employees paying Social Security tax are going to see an increase this year (fwiw they go up every year about in line with wage growth, so this one is not really new). The top rate is moving up about 5% or $521/year coming out of your paycheck.

For our readers who are already drawing Social Security, congrats your getting more money in 2024. Your cost of living adjustment (COLA) will be +3.2% higher in 2024 from 2023 which on an individual basis works out to an extra $59/month or $705/year.

Your 2024 tax refund won’t change.

If you saw a big drop in your tax refund in 2023 you aren’t alone. Most people did due to the expiration of several pandemic-related policies. This year though, don’t expect a similar change.

In fact, experts are predicting that 2024 will see an average tax refund of about $2.9k— which is about the same as 2023. The timing of refunds is also likely to be similar so you shouldn’t expect any delays (but of course… it’s the government… so no promises).

Remember your child tax credit.

Yes you get some small relief for those little people running around your house in the form of the Child Tax Credit. No, it’s probably not going to allow you to pay for everything they broke this year. In 2023, the Child Tax Credit is $2,000 per child age 17 or younger.

It’s worth noting though that the credit is subject to a phase-out (i.e. its going away) starting at joint filers who earn $400,000 or more and single filers who earn $200,000 or more.

IRA and 401(k) limits are slightly higher this year.

If you have any of these retirement accounts you can contribute more this year than last year (if we lost you at IRA, here is a simple guide). The traditional IRA and Roth contribution limits in 2023 for individuals is up to $6,500 to an IRA, and those age 50 and older also qualify to make an additional $1,000 catch-up contribution.

In addition, the 2023 contribution limits for tax-deferred 401(k)s and Roth 401(k)s have increased to $22,500. If you're age 50 or older, you qualify to make an additional $7,500 catch-up contribution for this tax year as well.

Watch out for new tax brackets coming in 2024.

Tax brackets are adjusted slightly higher each year, but largely due to recent inflation numbers, the IRS just announced the second highest increase in the past 30 years for 2024 (so this one will apply to your 2025 taxes).

Tax brackets for 2024 are moving up by 5.4%… so for example the new joint filer threshold for 24% federal rate means you have to have income over $201,050 vs. the previous threshold of $190,750. Bottom line, these new brackets will likely allow you to take home more of your pay.

👪 Closer to home: We generally side eye most taxes because we know these dollars are abused and wasted by politicians (did you know the U.S. didn’t actually have an income tax until 1913?), but it’s better to be informed.

Lastly a disclaimer, we aren’t tax accountants ourselves so use the above as a starting point with your own professionals (or Turbo Tax) to ask questions and get more details on your specific situation.

Dining With Masterworks

Billionaires wanted it, but 61,578 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and fractionalizing some of history’s most prized blue-chip artworks for its investors.

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Basquiat, all of which are collectively owned by everyday investors. When Masterworks sells a painting, investors could get a return.

Offerings can sell out in minutes, but Future Funders readers can skip the waitlist to join with this exclusive link.

Investing involves risk and past performance is not indicative of future returns. See important Reg A disclosures and aggregate advisory performance masterworks.com/cd

Dinner Discussion ❓

The Side Dishes

Headlines That Matter

🏠 The housing platform Realtor.com is predicting a mixed housing market for 2024. Prices will slowly come down, housing supply will increase a bit and rental prices are going to come down. But most people probably won’t budge if they have already locked in a mortgage rate under 4%.

💳 Mastercard gave an update for holiday spending (from Nov 1st through December 24th) noting an increase of 3.1% over last year. While there are pockets of concern (see Nike), consumer spending remains strong.

🪙 For anyone following the cryptocurrency market, we would expect a ruling sometime around January 10th from the SEC granting a few firms the right to start a Bitcoin ETF (we previously talked about this a couple months ago here… if we lost you at ETF, we explain that here too).

📋 Because people actually have to put their money on the line, it’s a little known secret that a lot of investors like watching election betting odds vs. looking at polling data. As noted last week, presidential election years tend to be positive for the market but there is a lot of volatility under the surface based on the different policies of candidates and who the market thinks will win (here are the latest betting odds).

🏭 In last weeks poll 59% of you thought the economy would be better in 2024 vs. 2023. The experts tend to agree with most predicting that we see an economy in 2024 that is on track to be the first “normal” economic year this decade. Now we wait and see who is right…

⚾ Thinking about starting a side hustle in 2024? Check out this recent short video interview with TEDx keynote speaker and business strategist Jennifer Morilla on how to get started, save money, and earn more income.

🎾 We absolutely loved this essay reminding us that time is in fact our most precious commodity. That’s why we should take time with our kids to ‘stop and watch the bees.’

🍨 Dessert

Deals, Reads, And Other Finds

🛏️ If you want to earn some income renting out a room but don’t trust short term vacationers or partygoers we found a cool alternative. Furnished Finder offers the chance for you to list rooms to traveling nurses and other professionals working on assignment all over the United States.

🧺 Who says doing laundry doesn’t pay off? There are people actually earning $6,000 a month by doing other people’s laundry with Hanpr.

🏈 NIL Wire helps you stay up to date on everything surrounding NIL in college athletics. Read by sports enthusiasts, coaches and ADs all over the US. Subscribe here!

🪙 Get the top Crypto headlines before anyone else, 2x a week with Nifty Nest. Join 10,000 crypto investors and founders today and sign up here!