Together With

Hey {{ First_Name | Future Funders family }},

We were sad to hear that Charlie Munger passed last week at 99 years old. Mr. Munger was one of the greatest investors of all time most famously know as Warren Buffett’s partner at Berkshire Hathaway.

His keynote address at USC Law School graduation in 2007 is worth every parent watching and talking about with your kids.

Okay let’s get to it…

💬 Quote Of The Week

“Raising kids is like being constantly surrounded by a tiny sales team. They’re always trying to persuade you into doing or buying something. And they assume everything you say is just an opening offer.”

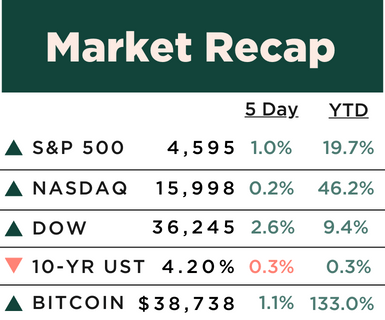

🚀 What’s happening: Markets were hot in November with most of the major indices above up about 9% on the month.

The hot run can be attributed to two main reasons:

People now firmly believe inflation is under control and the Fed is done raising interest rates.

People also now believe we will start to see interest rates move lower by mid 2024.

The expectations for where rates sit at the end of 2024 have come down dramatically through November; at current levels the market is now factoring in a year end 2024 interest rate of a whopping 3.99% (from 5.25-5.50% now).

👪 Closer to home: We are a bit more cautious on the current interest rate forecasts being priced into the market thinking it’s unlikely that rates will fall that fast (3.99% a year from now looks a bit crazy to us). As such, we take a more neutral stance on the prospect for a continued stock market run in the near term.

*Stock data as of 12/1 market close, bitcoin as of 4pm 12/1. Here is what these numbers mean.

🍽️ Main Course

Your Money And Your Kids

Chose Wisely

🚀 What’s happening: After years of savers getting hosed by low interest rates, 2023 finally gave us some low risk options to stash our cash and still earn a return above inflation.

For example, putting your money in simple U.S. Treasury Bills or certificates of deposit (CDs) can earn you a 4% or 5% return with inflation right now running at 3.2% based on the latest Consumer Price Index (we talk about low risk investment options in more depth here).

Investors in the stock market also are doing well this year with the S&P 500 up almost 20% year to date (although it’s worth pointing out here we are still below the market’s peak hit on January 3rd 2022).

Whatever you invested in, most families’ 401(k)s or brokerage accounts were positive, which is a relief after a tougher 2022 for most people.

But now we all have to make an important decision with our investment accounts as we look to 2024.

Explain.

If the market is right and we start to see interest rates move lower in 2024, this will also lower the interest we will receive on low risk investments (Treasury Bills, bonds, CDs, etc), possibly to a point below inflation again.

On the flip side, after the run the market has had this year, it’s hard for anyone to confidently say how it will do in 2024. After all, it’s not hard to look around and see risks (economic slowdown, geopolitical risks, global elections, etc). Leaving money mostly in the market then would mean another role of the dice.

So the question for all of us today to consider is what do we do with our investment mix?

Do you try to allocate more money to locking in the 4 or 5% interest rates you can get today by buying longer term safe investments before they come down (ex. 5 year CDs or 10 year Treasury Bills), or do you roll the dice with most of your investments and play the market again in 2024?

👪 Closer to home: We caveat our view here by saying the answer likely will depend on you and your family’s unique situation.

If you are younger and have more time until retirement, maybe you can roll the dice a bit more with your 401(k) or investment accounts and allocate a bigger portion to stocks. If you are older and closer to retirement, maybe you allocate a bit more to locking in a 5 year CD rate (for example) because that rate is likely to move down should interest rates move down.

There is no one right answer here no matter what any “financial expert” may tell you and you should do what you think is best for you and your family (we will always tell you that).

The time to start thinking about it is now though, and remember, if you have any questions we are always just an email away to help.

Dining With Better Gift Coach

Cut stress from your holiday season with your new gift-brainstorming shortcut – for free.

This December, picture yourself leisurely kicking up your feet and smiling with excitement as you imagine the faces of your loved ones when they eventually open your gifts this year.

In past Decembers, you found yourself scrambling to set aside headspace during the busiest month of the year to brainstorm MEANINGFUL gift ideas, only to often settle for presents that felt more like check-the-box exercises.

This December, instead of trying to brainstorm home run gifts on your own, gain free access to a one-of-a-kind, ever-growing collection of inspiring real stories of the best gifts ever given.

Then, simply recreate your own versions of those winning gifts for the people on your list.

Featured in The New York Times and Real Simple Magazine, the free Better Gift Coach newsletter takes a different approach to gift-brainstorming by inspiring you with stories of awesome gifts and guidance on replicating them.

Dinner Discussion ❓

The Side Dishes

Headlines That Matter

📈 When smart investors speak it doesn’t always mean they are right but it’s worth at least paying attention. As one of those people, Bill Ackman just sat down for a short interview sharing his strong view that interest rates will start coming down as early as Q1 2024.

🏠 More and more homes are starting to sell at a loss (3% this year up from 2.4% last year) with the average loss of $40,000. If interest rates do in fact come down in 2024, the environment next year would likely set up better for buyers (although there is a lot of current pent up demand to get through).

💵 The U.S. dollar decreased about 4% in the past month against other large global currencies because of the view that interest rates will not move higher (while not the only factor, all else equal when interest rates go up the dollar gets stronger and visa versa). A weaker dollar is something watch next year as it will make imported goods and vacations abroad more expensive for families (so maybe wait on that European backpacking trip).

👎 Continuing jobless claims (this is the continued weekly unemployment benefit claims made by people) last week rose to 1.927 million vs. estimates of 1.865 million. Almost 2 million unemployment benefit claims is the highest weekly number since 2021 and points to a clear sign that employment fundamentals are weakening.

📱 As if you need another reason to take your kid’s phone (or at least monitor their apps). Meta is now being accused of collecting children’s data from Instagram accounts.

🎄 How much to spend on our kids for the holidays is something we wrestle with in our family every year. We enjoyed reading this psychologist's take on what it could mean for their development.

🍨 Dessert

Deals, Reads, And Other Finds

🤖 Learn AI in 5 Minutes a Day with the AI Tool Report. We'll teach you how to save time and earn more with AI. Join 300,000+ free daily readers for AI tools, tips, and news. Sign up here!

🚴 Need new shoes for your Peloton bike? Use Code NEWSHOES40 at checkout for 40% off Peloton Bike Shoes.

👚 Need a good gift idea? Eberjay wants to make it easy for our readers looking for luxury sleepwear by offering 10% on full-priced items with code PJ10.

⛹️♀️ Get “the gist” on the business side of women's sports in just 5 minutes. Biggest deals, trends, and insights straight to your inbox. Subscribe here!

*our goal is to always keep this newsletter free. If you buy or subscribe to something through our newsletter we may earn a small commission, at no added charge to you, in order to help us keep the lights on

Dinner Discussion ❓

Answer: While there is no “right answer” to this one, historically December tends to be a positive month for stocks. For the 20 prior Decembers (2003 to 2022) the S&P 500 has risen in 14 of those years (70%) with an average return of 1% (all years).

❤️ Invite Your Family

Thanks for reading {{ First_Name | Future Funders family }}! If like us, you believe in the power of financial freedom, we welcome you to share this newsletter with your family. Have them sign up here!

Together With Better Gift Coach

This issue of DTD was sponsored by Better Gift Coach. In just 1 minute a week, be relieved & excited to have MEANINGFUL gift ideas. Check out Better Gift Coach today!