Welcome back, Future Funder

This week we’ve got a wild ride through the world of plastic and pixels. We're diving deep into America's trillion-dollar credit card obsession, exploring the highs (or lows?) of our collective spending spree. Plus, we're decoding the mystery of credit scores and serving up some juicy news bites. For desert - Aladdin joins the fun. Let’s dive in!

On the menu today

🏔️ We’ve peaked! Credit hits a trillion

🎰 Credit Scores 101: Your $ GPA

🛠️ Debt trends & new credit tools

📰 Roundup: FAFSA, Costco, 401k

🧞 Aladdin’s Credit Adventure

FAMILY FORCAST

America’s Trillion Dollar Credit Addiction 💉💳

America's love affair with plastic is reaching new heights - or depths, depending on how you look at it. The Federal Reserve Bank of New York dropped a bombshell: we've collectively racked up a mind-boggling $1.14 trillion in credit card debt 🤯

Meanwhile, TransUnion reports the average credit card balance has swelled to $6,329, up 4.8% from last year. It's like we're all on a shopping spree, but the hangover is starting to kick in.

The New York Fed says about 9.1% of credit card balances have slipped into delinquency over the past year. Compare this to the end of 2023, when that number was just 3.1% overall.

Did You Know? The total U.S. credit card debt is more than the GDP of many countries, including the Netherlands, Saudi Arabia, and Switzerland!

Number Crunch: 👀

$1.14 trillion: Total U.S. credit card debt

$6,329: Average credit card balance per person

9.1%: Percentage of credit card balances in delinquency

48%: Increase in credit card debt since early 2021

20%+: Average credit card interest rate

With interest rates sky-high and debt levels soaring, it's more crucial than ever to teach our kids about responsible spending and the true cost of credit. Here's your action plan:

Debt Detox Challenge: Commit to a "no new debt" month and focus on paying down existing balances. Learn more about debt reduction strategies

Interest Rate Limbo: Call your credit card companies and negotiate lower rates. You'd be surprised how often this works! Tips for negotiating with creditors

Family Activity - Credit Card Simulator: Use play money to teach kids about credit, interest, and responsible borrowing. More educational resources for kids and credit.

Dinner Table Discussion: Put your thinking caps on. What’s the best credit score to have, 850 or zero? (Hint: it’s more complicated than you think, often argued from both sides).

THIS WEEK’S POLL

How many credit cards does your family juggle?

*One-click, easy voting. Remain anonymous.

Our last poll, we asked: "How often do you update your passwords?"

Here's what you all had to say:

Honest answers indeed! Nearly 73% of you admitted to only updating when forced to. On the flip side, we do have quite a few security pros staying on top of their logins. We salute you 🫡

For those of us who still haven't picked a password manager to stay organized, check out the top ones here.

BACK TO SCHOOL

Today's Lesson: Understanding Credit Scores 💳

This three-digit number plays a significant role in many aspects of our financial life, from securing loans to renting apartments. Let's dive into what a credit score really means and why it matters.

In simple terms: A credit score is like a financial report card for adults. It's a number, typically between 300 and 850, that represents your creditworthiness.

Just as a high GPA shows academic excellence, a high credit score indicates responsible financial behavior to lenders and creditors.

Why You Should Care: Your credit score can impact your ability to achieve major life goals, like buying a home or starting a business. A good score can save you thousands of dollars in interest over time, while a poor score can lead to higher rates or loan denials.

Biggest elements that make up your score:

Payment History: This is the most significant factor, accounting for about 35% of your score. It shows whether you've paid past credit accounts on time.

Credit Utilization: This represents how much of your available credit you're using. It's best to keep this under 30% of your total credit limit.

Length of Credit History: The longer you've had credit accounts open and in use, the better for your score.

Credit Mix: Having a variety of credit types (e.g., credit cards, mortgage, auto loan) can positively impact your score.

New Credit: Opening several new credit accounts in a short period can lower your score temporarily.

Getting Started with Credit Scores:

Check your credit report: Review your free annual credit report from each of the three major bureaus at AnnualCreditReport.com.

Monitor your score: Many credit card companies offer free credit score monitoring. Sign up for these services to track your progress.

Pay bills on time: Set up automatic payments or reminders to ensure you never miss a due date.

Reduce credit utilization: Pay down existing balances and consider asking for credit limit increases. Learn more about credit utilization at Experian.

CREDIT SCORES - IN THE NEWS

The Tide is Rising 🌊

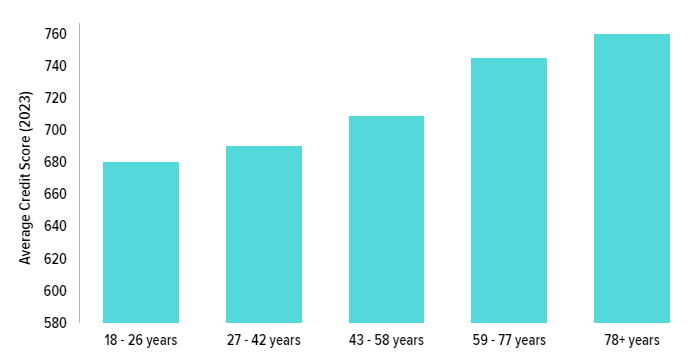

Remember how we said credit scores were like financial report cards? Well, America's grades are on the rise. The average FICO Score hit a record high of 715 in 2023. But before we celebrate, let's break it down by age.

It turns out that credit scores, much like a fine wine - improve with age. The 60+ crowd is leading the pack with an average score of 753, while Gen Z (18-29) is hovering around 680. Don't worry, kiddos – there's still time to refine your financial palate.

Experian has introduced a new feature that allows you to add rent payments to your credit report. This could be a game-changer for those who've been diligently paying rent but haven't seen it reflected in their credit scores.

On the debt front, U.S. household debt reached $17.3 trillion in 2023. While most of this is mortgage debt, credit card debt saw a concerning 16.6% jump.

Pop Quiz: How many points can a single late payment potentially drop your credit score?

*One-click, see result. Remain anonymous.

LET’S GO AROUND THE TABLE

Everything else you need to know today

Source: CNBC

Costco's Scanning Shake-up. Heads up, Costco shoppers! The warehouse giant is testing self-service membership card scanners at entrances. Faster lines or tech troubles?

Childless by Choice. A recent Pew Research study came out highlighting a growing number of Americans are opting out of parenthood, with 57% of adults under 50 who are unlikely to have kids.

401(k) Cash-Out Caution. New rules for 401(k) cash withdrawals are on the horizon. The changes aim to simplify rollovers and save us from hefty taxes and penalties.

FAFSA Faces Delays. College-bound students will have to wait until December to start their financial aid applications for 2025-2026. The Education Department's phased rollout aims to address last year's glitches.

CREATIVE FINANCE - ART EDITION

Aladdin’s Credit Carpet & The Cave of Wonders ATM💳

🧙♀️ Your wish is our command

What did you think of today's email?

Thanks for reading.

Until next time!

The Future Funders Team 🍽️

p.s. If you liked this newsletter, share it with your friends and colleagues here.