Hey {{ First_Name | Future Funders family }},

If you needed another reason not to trust big tech, we’ve got one for you. Google is now being accused of faking a mind blowing demo video highlighting the launch of their ChatGPT competitor, Gemini. Remind me when Black Mirror comes back?

Okay let’s get to it…

💬 Quote Of The Week

“My wife makes us put $5 in the “find jar” every time we make her find something we can’t locate in the house. After 13 months of saving, today we are buying a Ford Explorer.”

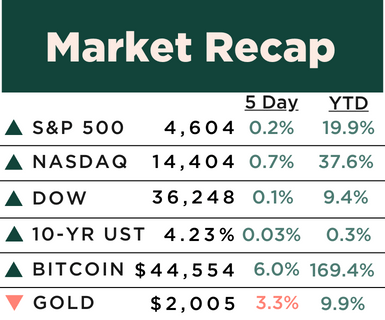

*Stock data as of 12/8 market close, bitcoin as of 4pm 12/8. Here is what these numbers mean.

🚀 What’s happening: Markets didn’t do much over the past week as most investors are awaiting 1) the next inflation data point in the form of the Consumer Price Index (happening 12/12) and 2) the Federal Reserve meeting (also happening on 12/12). Most are hoping it will confirm the current view that rate hikes are done.

Bitcoin and other cryptocurrencies continued to rally (with the former up 6% on the week) as investors anticipate SEC approval of a Bitcoin ETF likely over the next month or two (what’s an ETF?).

The price of gold also hit all time highs in the past week; the metal historically tends to rise amid geopolitical uncertainty (the thinking is that if everything collapses people will still value gold) and also when the U.S. dollar gets weaker (since it is priced in dollars).

👪 Closer to home: The S&P 500 currently sits at its highest value of the year, and in our view the market is pricing in a lot of optimism (we still remain a bit more cautious right now looking into 2024).

The Bitcoin rally is worth noting, but oftentimes when a rally like this happens in anticipation of a positive event, once the actual event happens prices go down instead of up… as they are expected to (this is called “sell the news”). The reason is that once the anticipated event happens, everyone has already bought the asset and so there is no one left to buy. Not saying it will happen here, but it’s a pattern we have seen many times before.

And lastly, before getting to hyped up on gold, it’s worth noting that in the past 10, 30, 50, 80, and 100 years, the S&P 500 has significantly outperformed gold. But for anyone who believes global uncertainty will continue in the near term, the commodity might be a good consideration for at least some of your investment or 401(k) dollars.

🍽️ Main Course

Your Money And Your Kids

The College ROI Problem

🚀 What’s happening: The concept of return on investment (ROI for short) measures how well an investment performs.

Most people think about this concept when it comes to money (i.e. I used $100 to buy this stock and now it’s worth $150), but ROI actually applies to everything we do in life.

There is a return on investment in how we use our time, what we eat, or how closely we pay attention to what our kids are learning in school.

Today, it seems like no matter how you look at the ROI on higher education for our kids, the downsides and risks just keep piling up.

Explain.

Let’s start with the financial ROI on higher education which has been going the wrong way for a long time now. Over the past 20 years, college tuition costs have risen about 10x faster than wages (adjusted for inflation) putting families everywhere in a bind. To make matters worse, given the extraordinary costs of tuition (especially at “elite” universities), most fields of study simply aren’t worth the cost of tuition today.

But now, we parents also have to worry about the ROI on time our kids are spending at some of these universities. Who is teaching them? And what are they learning? Their mindset and their ability to think critically (or not) about the world around them when they get out is the personal return they get on the investment of four years of their time.

What opened our eyes?

We listened to the testimonies of the presidents of MIT, Penn, and Harvard this past week before Congress where they did, in our personal opinion, mental gymnastics as they explained away the rise in on campus antisemitism since October 7th. More specifically testifying that it depends on the “context” to determine whether calls for genocide violated codes of conduct.

For starters, we are generally skeptical of most politicians, and particularly loathe when snippets of clips are pushed without providing the full video, but even when we watched the full hearing here, it only made their statements look worse.

To any parent who has paid attention to the news over the last few years, these “elite” universities didn’t need “context” for countless other causes they deemed worthy, and we all know that calls for genocide of any other minority group would not be tolerated.

Whether you agree or not, the point now is that at some of the “best” universities we have to offer, these are the people teaching our kids. As parents, that made us sit up and think about the concept of ROI on higher education a little harder.

👪 Closer to home: We don’t want to paint all higher education with the same brush, as there are so many dedicated professors and universities out there.

However, the point is that (now more than ever) we really have to pay attention to who will be teaching our kids. Demonstrating how to think critically about the world around them and to always be open minded is perhaps the greatest possible “return” we can get on our time investment.

Dining With Adpatigo

Auto Insurance: Overpriced!

Just because you have to renew your auto insurance every 6 months does not mean you have to overpay!

The sad truth: 50% of U.S. drivers overpay for their auto insurance.

There are 3 SIMPLE steps to solve the problem:

Step 1) Visit our page on this

Step 2) Enter your Zip Code, fill out a 1-page form

You will really enjoy the benefits of this simple process; you no longer have to be in the 50% that overpays!

Dinner Discussion ❓

What topic below do you want to learn most about in 2024?

The Side Dishes

Headlines That Matter

🏎️ If you are in the market for a new car, it might pay to wait. Manheim just released data noting that used car prices in November dropped 2.1% from October and 5.8% from last year. Car prices are still about 25% above pre-pandemic levels but with the supply chain now in better shape and the auto strikes behind us, we would bet prices will start coming down fast into 2024.

🧾 Giving our hard earned money to wasteful politicians is bad enough. What’s worse, the IRS just quietly passed a new rule for 2024: if you underestimate your tax payments you are going to be charged 8% interest (it was previously 3%).

👕 Before you do anymore holiday shopping this season, be aware that more and more retailers are not accepting returns. Figuring out how to dispose of these items has become so unprofitable that about 6 in 10 retailers are now just making you figure out how to get rid of your items while just sending you the cash.

📈 A recent study in the Wall Street Journal looked at which industry ETFs did best during during market downturns and upswings. If you want the cliff notes, the findings pointed to less difference in what industry ETF you invest in during an upswing, and during a downturn its best to stick with consumer staples (think Coca Cola) over technology ETFs. If we lost you at ETF (I lost my wife here), we explain what these are too.

👎 The Supreme Court is hearing a case right now worth paying attention to as it has implications for future tax law. At issue in Moore v. United States is whether or not the U.S. Government can tax unearned income (i.e. investments that have gone up but not actually paid any gains). Indications are they may uphold the tax but not open the door for other attempts to tax unearned income (i.e. a wealth tax).

👏 We loved seeing the news that CVS is overhauling their drug pricing in an effort to make it more affordable. The new pharmacy model, called CostVantage, will show what the company pays for the drug and apply a small, transparent mark up.

🎄 While we wouldn’t call this an immediate problem, The Panama Canal (about 5% of all world trade runs through it every day) is getting backed up due to congestion and low water levels. If this continues it could push prices (on things like oil) higher again in early 2024.

🍨 Dessert

Deals, Reads, And Other Finds

🏈 NIL Wire helps you stay up to date on everything surrounding NIL in college athletics. Read by sports enthusiasts, coaches and ADs all over the US. Sign up here!

👚 Carter’s holiday collection has everything you need to dress your family this season—Get up to 50% off from family holiday outfits to baby’s first Christmas, family matching pajamas (sizes newborn to adult) and more.

🏎️ Stay ahead of the curve in the collector and modern car auction world with the Daily Vroom’s free 5-minute daily (Mon-Fri) newsletter. Subscribe here!

*our goal is to always keep this newsletter free. If you buy or subscribe to something through our newsletter we may earn a small commission, at no added charge to you, in order to help us keep the lights on

❤️ Invite Your Family

Thanks for reading {{ First_Name | Future Funders family }}! If like us, you believe in the power of financial knowledge (or just want your kids to get a clue!), share this newsletter with your family by having them sign up here!