Together With

Hey {{ First_Name | Future Funders family }},

Before you go into turkey and gravy and football mode this week, we wanted to extend our utmost thanks to all 30,000 of our readers.

It has been a wild ride since we launched this newsletter in February, and we are excited for everything we have coming down the pipeline that will help make finance easier for all families.

Until then, Happy Thanksgiving to you and yours!

Okay let’s get to it…

💬 Quote Of The Week

“A toddler can do more in one unsupervised minute than most people can do all day.”

-Anonymous

🍽️ Main Course

Headlines That Matter

Interest Rate Roller Coaster

🚀 What’s happening: Interest rates are sitting at 23 year highs, but experts are now predicting they will start to come down soon.

Why?

Recent datapoints signal that high rates are working to cool inflation.

Consumer Price Index (CPI) surprise. The latest CPI reading (this is basically an average of what we pay for stuff) came in lower than expected, telling us that prices in October were +3.2% from last year. Experts were predicting a +3.3% increase, showing continued improvement from September which was +3.7%.

What we focus on. We tend to focus on the Producer Price Index (PPI) more right now as this reading tells you what the companies who make your stuff are paying for their inputs (helping you determine whether companies will raise or lower prices for consumers). The reading here was also encouraging— with October price growth at +1.3% from last year vs. expert predictions of +1.9% and also below +2.2% in September.

So are we in the clear?

Yes, and… no. While we all welcome lower prices and growth, if the economic growth slows too much then our biggest worry will be a recession (layoffs, stock market correction, stagnant income, etc.).

Cautious comments on the consumer from companies like Walmart this past week have our eyes firmly watching consumer behavior over the holiday season to get a better read on where the economy is headed.

Ok, but where are interest rates headed?

Well, Wall Street is in the camp that rates will start to come down in 2024. UBS thinks the Fed could start lowering rates by March of 2024 with overall rates falling to 2.5% by the end of 2024 (they sit at about 5.25-5.50% now).

Most other Wall Street firms are also in agreement that rates will start to come down next year.

👪 Closer to home: Our view is that rates are likely to come down, but it may take a bit longer than people expect (unless of course we have that recession).

Inflation is a tough nut to crack and an overall interest rate right now of 5.25-5.50% is still well below prior historical peaks.

We would love to see real evidence that the CPI can get down closer to a 2% level before we start declaring victory.

Learn more about interest rates and inflation:

We’re Not Gonna Take It

🚀 What’s happening: Starbucks saw workers at more than 200 U.S. locations walk off the job last Thursday arguing for better pay, benefits, and working conditions (as of this publishing Starbucks has mostly yawned at the demands - they operate about 16,000 total stores in the U.S.).

So what?

If it seems like a new labor strike is in the headlines everyday, it’s because it is; 2023 has been a record year for labor strikes.

From healthcare to Hollywood writers to auto workers— over 400,000 workers across the country have walked off the job year to date compared to an average of about 150,000 over the past 15 years.

Why now?

Because while most traditional media remains puzzled why the average American thinks the economy is poor— the answer is staring us all right in the face.

Even though headline numbers (like unemployment, GDP, etc.) are good, wage growth has not kept pace with inflation since the start of the pandemic.

If your wages aren’t keeping pace with your costs, no other headline stat matters. Period. Which is exactly why all of these workers are going on strike.

So it’s all bad news?

No, there is hope! For the sixth month in a row we have started to see wage growth outpace inflation.

The latest reading showed October wage growth at +4.1% (and as noted above the CPI, or inflation, was +3.2%). We would like to see the wage growth vs. inflation gap widen, but it’s at least nice to be back in positive territory.

👪 Closer to home: Labor strikes tend to be a symptom of a lack of wage or job satisfaction, and it’s no coincidence we see an uptick now (the last time we had this many people striking was in the 1970s- also a time of high inflation and low wage growth).

Whatever you do for a living, we are all just tying to give our kids a better life than we had. Being stuck in a job you hate or not earning a wage that keeps up with inflation makes the situation even harder.

Our view is that it’s never too late to change, switch careers, ask your boss for a raise, or truly set out to live the life you want to live.

Remember, big change is just a series of small changes, so if you think you want to start moving in a different direction, why not start today (and we are always an email away for encouragement!).

Some further reading around career and money:

Dinner Discussion ❓

According to a study commissioned by Campbell's, what is this year's most popular Thanksgiving side dish?

No peeking! Answer is below.

Dining With Masterworks

Billionaires wanted it, but 54,578 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and fractionalizing some of history’s most prized blue-chip artworks for its investors.

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Basquiat, all of which are collectively owned by everyday investors. When Masterworks sells a painting – like the 16 it's already sold – investors reap their portion of the profits.

Offerings can sell out in minutes, but Dinner Table Discussions readers can skip the waitlist to join with this exclusive link.

Past performance is not indicative of future returns, Investing involves risk. See disclosures masterworks.com/cd

The Side Dishes

Your Money And Your Kids

📧 If you have old family photos or valuable information on an old gmail account now’s the time to get it out. Google will start deleting inactive accounts on December 1st.

🚀 Quarterly filings from famous investors recently came out which are always worth paying attention to. Warren Buffett’s Berkshire Hathaway made a big bet on financial stocks rising from here.

📅 An early warning on tax filing this year that should start getting more chatter. This year will be the first year Section 9674 goes into effect (IRS delayed this until 2023). This rule requires Venmo, Paypal, etc. to report transactions over $600 for which you will have to pay taxes.

👴🏽 Looking for some quick thoughts on planning your retirement? We put some together here.

✈️ Due to increased planes coming online and consumers pulling back on expenses, we are noticing that airfares are starting to really come down (October prices were down 14% from last year). If you are thinking about a family trip soon we would recommend setting price alerts (here’s how). Or you can just buy an all you can fly pass on Frontier for $499.

🥃 If you are a whiskey drinker it’s worth watching what happens to negotiations between the US and EU as tariffs of 50% are set to go into effect for American Whisky on Jan 1, 2024. Should this happen we would likely see increased supply in the US market and lower prices.

📱 As if we needed another reminder of the dangers of social media for our kids, Nepal just became the latest country to ban TikTok.

🚸 Interesting video take on how big tobacco intentionally made snacks addictive.

📚 Looking for ways to improve your credit score fast? Here are 5 tips we came up with.

🍨 Dessert

This Week’s Deals, Reads & Other Finds

👍 Techpresso gives you a daily rundown of what's happening in tech and what you shouldn't miss. Read by professionals from Google, Apple, OpenAI. Sign up here!

🏆 NIL Wire helps you stay up to date on everything surrounding NIL in college athletics. Read by sports enthusiasts, coaches and ADs all over the US. Subscribe here!

📚 #1 NYTimes Bestselling author Mark Manson sends out one idea, one question, and one exercise each week to help you achieve your next breakthrough. One click sign up here!

*our goal is to always keep this newsletter free. If you buy or subscribe to something through our newsletter we may earn a small commission, at no added charge to you, in order to help us keep the lights on

Dinner Discussion ❓

Answer: According to Campbell’s State of The Sides report for 2023 mashed potatoes overtook stuffing (last year’s #1 side) to claim the top spot this year (we are a mac & cheese household). Whatever side is your family’s favorite, we hope everyone has a safe and happy Thanksgiving!

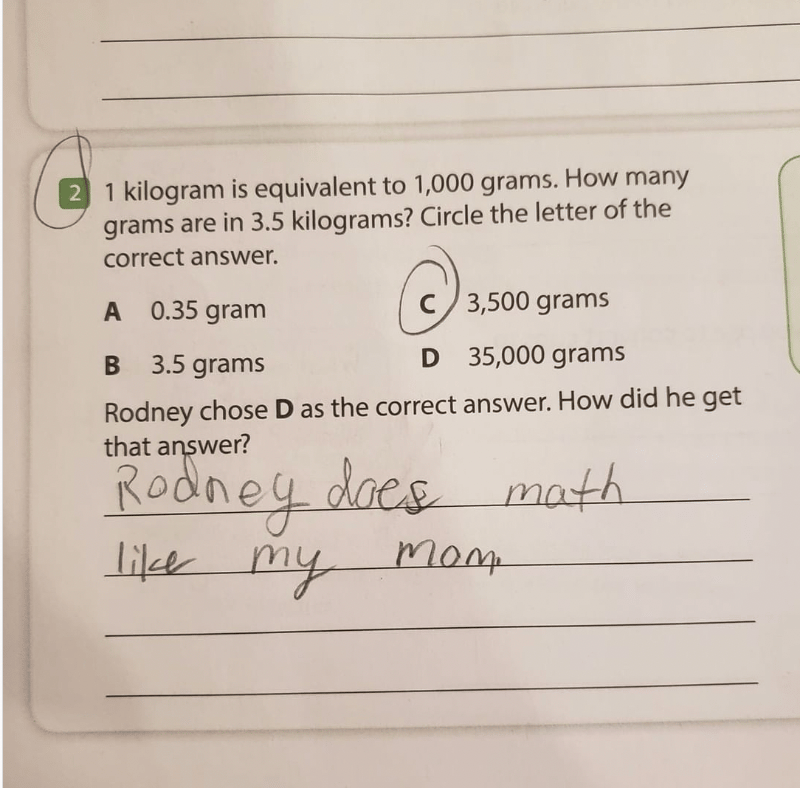

And before you leave us…a reminder that homework keeps you humble.

❤️ Invite Your Family

Thanks for reading {{ First_Name | Future Funders family }}! If like us, you believe in the power of financial freedom, we welcome you to share this newsletter with your family. Have them sign up here!

Together With Masterworks

Today’s issue was sponsored by Masterworks, the first platform for buying and selling shares representing an investment in iconic artworks. Check them out here.