Hey {{ First_Name | Future Funders family }},

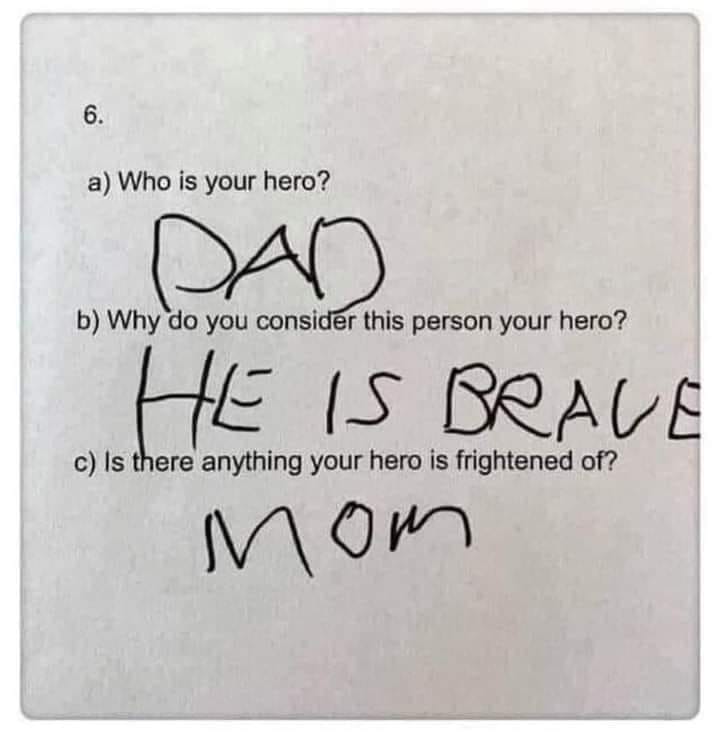

This girl dad spent some time with his nephews this weekend…

And wow… this pretty much sums up that experience.

Okay let’s get to it…

💬 Quote Of The Week

“One day I’ll be thankful that my kid is strong willed but that will not be today, not in this grocery store.”

-Anonymous

🍽️ Main Course

Headlines That Matter

November (Market) Vibes

🚀 What’s happening: The S&P 500 has been on a tear the first 12 days of November, up 5.3%. This rebound follows an awful three months for the S&P 500 index— down 2.2% in October, down 4.9% in September, and down 1.8% in August (the index year to date is up 15.0% sitting at 4,415).

Why? Two reasons.

Interest rates. When investors are fearful of interest rates moving higher, stocks go down (interest rates act like gravity to virtually all assets including stocks). Even though the Fed chairman this past week noted they are still ready to raise interest rates further if needed, the market is betting they are done (and that interest rates will start coming down by May 2024).

Seasonality. Humans have behavior quirks that show up in the way we trade stocks too; since 1950, the best months for trading stocks tends to be the six month period from November through April. As such, we are right on queue.

Side note: there are a lot of theories for this, but we think one of the reasons is because investors just want to put past emotions behind them and look towards the next year with more optimism. Similar to the phenomenon of how many parents (and grandparents!) forget about all of those sleepless nights during the newborn phase… hope springs eternal.

So what happens next?

Anyone’s guess. But for our two cents, after the recent rally we think the next move will remain more rangebound as the market digests this move upward and waits for important economic data on the horizon (with the next big one being Consumer Price Index report on 11/14).

Even if the report is positive (meaning we see further progress on inflation easing), at a level of 4400-4500 the market starts to bump up against valuation hurdles, so we are more cautious that we might not get much more of a rise than where we are now.

👪 Closer to home: While it can be fun to predict these short term moves in the market, for the long term investor (which we and most families are) they are largely irrelevant.

For our own investments we tend to follow the old adage: “time in the market is much better than trying to time the market,” meaning that just investing a little bit consistently is the best way forward.

To try and trade the next move of the market, all of us as individual investors are at a huge disadvantage compared to large institutions that utilize a massive amount of (very expensive) data that typically provides them with more insight (which is actually our founder’s day job).

What the individual investor has that larger institutions don’t, is time; you see, if banks and hedge funds are losing money, they typically don’t wait and hold a stock, they sell it regardless of the outlook. That, is your advantage.

So stay the course, always know what you own, and remember that the best time to invest in the market is when everyone else is panicking.

Learn more about investing:

Watching The Housing Market

🚀 What’s happening: Two recent changes in the housing market are worth paying attention to…

First

A federal judge in Missouri found the National Association of Realtors liable for $1.8 billion in damages for conspiring with large brokerage firms to keep commissions high.

We are now waiting for the appeals process to play out, but in all likelihood the days of a 6% brokerage commission on the sale of your house may be over soon.

Second

Don’t look now, but housing affordability is starting to see (small) improvements.

Mortgage rates have seen one of the biggest drops in several years; the average 30 year rate today is now sitting at 7.87% vs. 8.08% on October 31st.

Also, Redfin just reported that 7% of homes for sale on their site reported a price drop in the last week, the largest proportion on record.

While these are small changes, we have been searching for any signs at all of the home buying market taking a better turn, and this recent data has us a bit more hopeful that rates and affordability are headed in a better direction.

Be sure to keep your eye on the 30 year rate from here on out, as it should react to the CPI report this week as well as all inflation and interest rate data points we get through the end of the year (you can track the average 30 year fixed rate at this site and check out our free mortgage calculator here).

👪 Closer to home: When it comes to the Missouri lawsuit, should the appeals process fail (most indications currently are that it will), the repercussions on home buyers and sellers will be as follows:

More flexibility for sellers and buyers. Under the current system, sellers pay their own agent’s commission of about 5% to 6% of the selling price. This commission is usually shared with the buyers agent, but if that goes away now the buyer would have to pay their own agent (if you choose to use one) at a flat or hourly fee. If you are a seller, your agent payment may go down and you may get to keep more of your home’s selling price.

More savings needed for buyers. For homebuyers or investors in real estate, the ruling will likely add another cost to the home buying process. Make sure to consider what your broker will cost (ask them up front) when you look to buy a home.

More on home buying and ownership:

Dinner Discussion ❓

Which youth sport is the most expensive for kids?

No peeking! Answer is below.

Dining With Ryse

Last chance to invest before this company becomes a household name

What if you had the opportunity to invest in the biggest electronics products before they launched into big box retail, would you?

Through retail distribution deals with Best Buy, Ring changed doorbells and Nest changed thermostats. Early investors in these companies earned massive returns, but the opportunity to invest was limited to a select, wealthy few.

The game has changed, and for once investors have the option to invest in a company that’s gearing up for a massive retail rollout.

RYSE is set to debut in 100+ Best Buy stores this month, and you're in luck—you can still invest at only $1.25/share before their name becomes known nationwide.

They have patented the only mass market shade automation device, and their exclusive deal with Best Buy resembles that which led Ring and Nest to their billion-dollar buyouts.

The Side Dishes

Your Money And Your Kids

🧾 The IRS just released the new 2024 tax brackets. Find out what they are.

💵 Think the US Dollar will be replaced as the world reserve currency? We have thoughts (spoiler alert: we are skeptical).

🤖 In a positive step, Meta just announced that all political ads on their platforms (Facebook and Instagram) will need to identify if the ads are using AI. Now if we could get the same level of concern for the negative impact they have on kids or sharing our data.

🐔 Tyson just recalled about 30,000 pounds of dino chicken nuggets after consumers reported finding small metal pieces in them.

🚸 54 second watch: How to praise your kids properly from neuroscientist Andrew Huberman.

📚 If you have older kids and want to get them started down the path of investing (or want to learn more yourself), here are 10 books we would recommend.

🏦 With interest rates still close to all time highs, don’t just leave your spare cash sitting in a checking account. Here are 5 low risk ways you can earn 5% or more on that spare cash.

🍨 Dessert

This Week’s Deals, Reads & Other Finds

👍 Curious or want to learn more about entrepreneurship? Profit+ is a newsletter catering to entrepreneurs with a curiosity spanning finance and politics looking to find fulfillment beyond monetary success. Sign up here!

🛒 Did you know that Amazon doesn’t wait until Black Friday to publish deals? Get ahead of the crowd and help you wallet by keeping an eye on their deals page today.

📚 Want to get into real estate investing but not sure where to start? Check out The Offer Sheet which brings you a curated list of the most unique and lucrative short term rental investment opportunities hitting the market the previous day, delivered daily. One click sign up here!

*our goal is to always keep this newsletter free. If you buy or subscribe to something through our newsletter we may earn a small commission, at no added charge to you, in order to help us keep the lights on

Dinner Discussion ❓

Answer: Ice Hockey is the most expensive youth sport, costing on average around $2,500 per year (per kid). In case you were wondering the least expensive youth sport would be: Track & Field.

And before you leave us…a reminder that our kids can be funny.

❤️ Invite Your Family

Thanks for reading {{ First_Name | Future Funders family }}! If like us, you believe in the power of financial freedom, we welcome you to share this newsletter with your family. Have them sign up here!