Hey {{ First_Name | Future Funders family }},

Making this snappy because we know were not alone in this ‘no school today’ Monday…

Let’s get to it.

💬 Quote Of The Week

“Money, like any other force such as electricity, is amoral and can be used for either good or evil.”

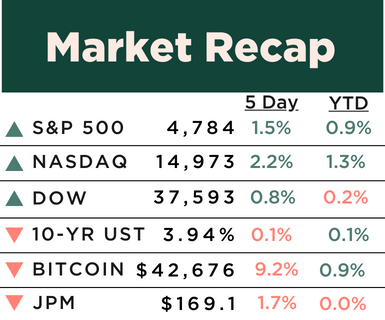

*Stock data as of 1/12 market close, bitcoin as of 4pm 1/12. Here is what these numbers mean.

🚀 What’s happening: Markets had a good week with most rising and now hitting neutral or slightly positive for the year. There wasn’t one thing to point to causing this result but overall it was a combination of investors still believing that interest rates are coming down and that the economy is holding up ok.

Company “earnings season” also officially kicked off on Friday with the large banks reporting (earnings season is when companies report their quarterly earnings to the public - the banks typically always go first).

JPMorgan Chase (stock ticker: JPM) along with other banks remained positive on the economy saying the U.S. consumer continues to mostly be in good shape.

👪 Closer to home: Earnings season can be a good way to get real time information about the economy because we get to hear what large companies are thinking (you just need to watch the headlines to get the gist).

It’s important as an investor though to remember that stock reactions themselves may not tell us whether an earnings report was good or bad. Good companies can report strong earnings but still have their stocks go down because investors were “expecting better”. The reverse is also true.

🍽️ Main Course

Topic In Focus

A Change Of Heart

🚀 What’s happening: After a long wait the Security and Exchange commission (SEC) just allowed 11 companies to market and sell a Bitcoin ETF to the public (if we lost you at ETF, we explain that here).

For anyone who wanted easier access to to invest in Bitcoin, this news is positive. But that’s not the whole story.

Let’s back it up…

As a result of the 2008 financial crisis, cryptocurrency (like Bitcoin) was created around the noble idea that big banks and our currency system are not dependable. That they don’t care about the everyday tax paying American (i.e. their customers) because it was us who were left holding the bag while they got bailed out.

Fair enough.

On cue, Blackrock and other large financial firms spoke out against Bitcoin and other cryptocurrency saying it was unstable and too volatile (among other things) to be considered an alternative currency. They floated the idea they would even need to see government backing in order to get involved.

Well, not much has changed except for one thing.

Bitcoin still isn’t backed by anything and the price is not any more stable today than it was when all of these concerns were voiced.

But today, the demand for cryptocurrency continues to skyrocket, so these big firms— like Blackrock— are now entering the ring because they found a way to make money with the asset after all.

WTF?… no, ETF.

In simple language, ETFs are baskets of assets that are traded on exchanges just like stocks. This means that you can buy and sell ETFs throughout the day, just like you would buy and sell stocks.

You see the simple way an ETF makes money for companies like Blackrock is by getting investors to buy it. When you hand them the money to buy their ETF, they charge you fees (which can be large if the market is big enough).

With bitcoin, some experts estimate that the Bitcoin ETF market could be higher than $150 billion… which amounts to a lot of potential fees and profits for these big firms.

What’s even better is that the SEC has only allowed 11 firms to start one, so anyone who didn’t get a stamp of approval is effectively shut out of the profit game.

Vanguard sitting it out.

The other stir this week was that one of the big firms, Vanguard, not only didn’t have an ETF but wasn’t going to allow clients to trade any of the current ETFs on their platform. They noted they don’t think Bitcoin lines up with their values, and whether this is true or just sounds good, they are likely to lose a lot of funds to competitors as a result.

👪 Closer to home: We take no position on whether or not a Bitcoin ETF is a good investment for your portfolio, we just think it’s important for our readers to know the full story of how the sausage is made before taking a bite. Happy investing!

Dining With RAD AI

This AI Startup Investment is Winning

RAD AI has developed technology that transforms the $633B MarTech industry. Its award-winning AI tells brands who their customer is and how to best create content for them.

1) $27M raised from 6,000+ investors, including VCs, execs at Google and Amazon. Backed by Adobe Fund for Design.

2) Dubbed “essential AI” for brands looking to attract new audiences and boost ROI.

3) 3X revenue growth, clients include Hasbro, Sweetgreen, MGM and more.

83% Subscribed, Invest Before Feb. 16th, Closing Soon.

Disclosure: This is a paid advertisement for RAD AI’s Regulation CF offering. Please read the offering circular at invest.radintel.ai

Dinner Discussion ❓

The Side Dishes

Headlines That Matter

🎈 The latest Consumer Price Index headlines had experts worried inflation might be stalling (consumer prices were +3.4% in December up from +3.1% in November); we were more focused on the Producer Price Index which came in below expectations and showed December wholesale prices down -0.1% from November. The fact that companies continue to pay less to make stuff is a good sign for consumers that they will start to lower prices on what they make and inflation should continue to trend down.

🤑 Did you know you can sell some of your unwanted holiday gift cards for cash? We didn’t and we were also surprised to learn that 13 states have actual laws on the books that require retailers to pay cash back to customers who have partially used their gift cards.

📈 A reminder that due to recent law changes starting Jan 1 of this year, parents can transfer up to $35,000 from a 529 plan into a tax-free Roth account (and set your kids up to be millionaires in the process).

📋 Curious about the average annual costs of popular pets? If your kid is begging you for a pet, maybe start explaining the costs to them with this. (And for the, record our dogs cost way more than $700 per year).

🏦 Home and auto insurance is becoming nearly impossible for a lot of American families - this was a good recap as to why that is.

🍨 Dessert

Deals, Reads, And Other Finds

🚰 Need a new water bottle for your 2024 exercise goals? Hydro Flask is offering up to 40% off for a limited time.

🏎️ Hertz is dumping about 20,000 of it’s electric car rental fleet and switching back to gas cars. With the government giving you an added $7,000 tax credit, you can get a Tesla for as low as $14,000. You can check out their inventory here.

📰 Impartial, trustworthy news that's actually enjoyable to read… The DONUT offers no jargon, bias, or sensationalized info not worthy of your time. Join 143,000+ other readers and get fast, witty updates from DC to Wall Street to Silicon Valley. Sign up for free.