Together With

Happy Monday {{ First_Name | Future Funders Family }}!

Fun fact for families headed to the ballpark this summer! Joe DiMaggio’s hitting streak of 56 consecutive games ended today as 67,468 people watched DiMaggio bat in the Cleveland stadium.

That has to be one of the toughest records still left unbroken in all of sports.

Okay, let’s get to it!

💬 Quote Of The Week

“You don’t stop laughing when you grow old, you grow old when you stop laughing.”

-George Bernard Shaw

🍽️ The Main Course

Headlines That Matter

Economy

Nothing Left To Fear (At Least Right Now)

🚀 The quick version: The economy at the moment resembles a scene of you just putting the kids to bed and sitting down with a glass of wine. Everything is calm and quiet (that is until you hear small footsteps or crying).

For the details:

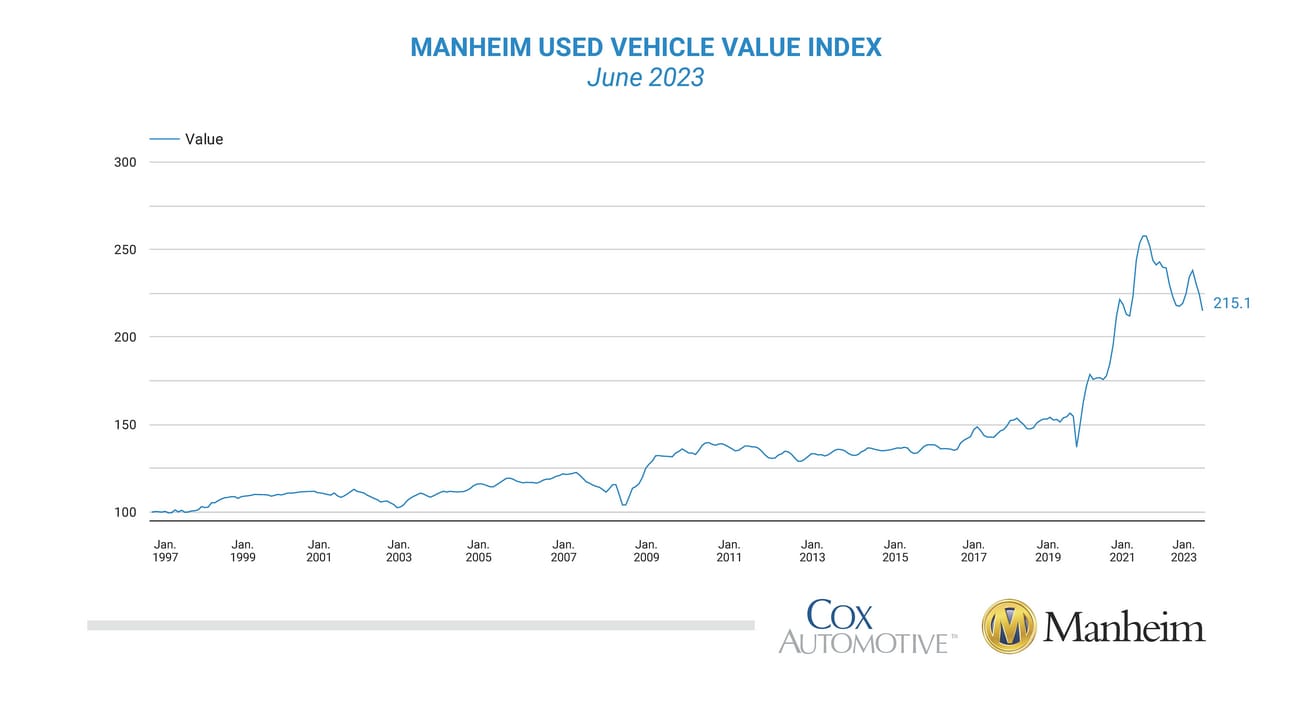

Used cars, anyone? Finally we are starting to see signs that used car prices are softening. The Manheim Used Vehicle Value Index (MUVVI) for June registered one of its biggest monthly drops in the history of the index, falling 4.2% from May. We’re not back to pre-Covid prices yet, but maybe we are finally headed in the right direction.

Inflation is down to 3% . The Consumer Price Index (CPI) for June (what Wall Street deems the official inflation number) tells us inflation is now down to 3% from 4% in May and a peak of just over 9% in June 2022…Finally. It was also nice to see categories like meat & dairy, gas, and airline fares drive the downward trend this month.

Producers are paying less for stuff. The Producer Price Index (PPI) for June also showed downward trends coming in at almost a zero pricing change to last year vs. almost 1% in May. When they pay less, you wind up paying less.

Companies seem optimistic (so far). 18 of the companies in the S&P 500 reported earnings, and on the whole said things were not too shabby. Companies like Delta, Pepsi, and JP Morgan all said the consumer was on solid footing and they were hopeful the remainder of the year would be a strong environment (they did share some risks however - worth reading what JP Morgan CEO, Jamie Dimon, had to say here).

👪 How it affects your family: With inflation coming down and a strong economic backdrop likely (at least over the next few months), these are some quick wins you can take to position your family better today.

Put your savvy shopper hat on. With inflation coming down, pricing from companies is going to get more dynamic. They will be forced to compete more by lowering prices and having sales (vs. using inflation as an excuse to just hold prices high). Set price alerts for things your family needs, looks for deals (we will try to highlight some), and stay patient if possible especially on big purchases (plane tickets, cars, etc).

Invest (wisely) with spare funds. The economy and the stock market are two different things (one being good does not mean the other will automatically do well, and visa versa). But good news is that with inflation just at 3%, you don’t have to buy stocks to beat it. Don’t just let spare cash sit in your checking account, ask your bank about high yield savings accounts, or investigate other safe places for your money that can earn over 3% (our quick guide to safe vs. aggressive investments).

Sponsored by Divvy

Try Divvy. Get $100.

Free yourself from manual expense reports with Divvy, BILL's spend & expense management solution. You can track and control spending, automate expense reports, and close your books in record time

Divvy offers:

Fully automated expense reports

Flexible and enforceable budgets

Scalable business credit that fits your needs

Get to know Divvy with a quick, 20-minute demo to claim your $100 Amazon gift card.

Medical Finance

Don’t Get Trapped By Probate

🚀 The quick version: Recent research shows that 64% of Americans think it's very or somewhat important to have an estate plan, but only 34% actually have one.

The result is that most families who have a loved one pass away wind up dealing with a lengthy and exhausting process know as probate.

Probate is the legal process through which a deceased person's assets are distributed to their beneficiaries. It involves validating the deceased's will, paying off any outstanding debts or taxes, and distributing the remaining assets according to the instructions outlined in the will. If there is no will, the court will determine how the assets are distributed based on state laws.

The process can take years and cost thousands of dollars leaving many families in limbo.

👪 How it affects your family: Even if you don’t think you have enough assets to need a plan, you should at least (just once) consult an estate attorney for extra details (for example, the cut off for probate in our home state of Florida is just $75k of assets).

However, there are a few steps you can take today:

Have a small estate. Most states set an exemption level for probate, offering at least an expedited process for what is deemed a small estate. In some cases, "small" actually can be quite large. Google your state's probate estate limits and consider giving assets to family before you die (a convertible 529 for kids can be a great option). This tactic might also trim or even eliminate future federal and state estate taxes.

Establish a trust. Don’t worry, it’s not as complicated as it sounds and it will ultimately cost less than probate court. Property held in a trust is not considered a part of your estate upon your death, therefore it typically avoids probate court. A trustee, not you, controls the trust property and is obligated to distribute it under the terms of the trust agreement (know the difference between a will and a living trust).

Make accounts payable on death. This is a big one and common issue. If you have any bank accounts just in your name, call them up today and make them payable to someone on death. Bank and other accounts that are payable on death go directly to your designated beneficiary without going through probate, as do life insurance policies with named beneficiaries. Some states also allow such transfers of real estate, called transfer on death deeds. Without doing this your loved ones may not even have access to your bank account when you die.

Own property jointly. Making your spouse or someone else a joint owner facilitates the transfer of the asset without the need for probate. Some ways to hold such assets include joint tenancy with right of survivorship, tenancy by the entirety and community property with right of survivorship.

Apple recently became the first company to be worth $3 trillion. Can you name their largest shareholder?

Answer below (no peeking!)

🥘 The Side Dishes

A few things to know…

🏈 The real cost of Football. It’s baseball season, but we found an interesting study ranking NFL teams on cost for a family of four to attend. Much to the dismay of the tortured Cleveland fan I am married to, the Browns were actually the second most expensive.

💵 Keep up with real estate. The Offer Sheet gives you free a curated list of the most unique and lucrative short term rental investment opportunities that hit the market the previous day, delivered daily (except Sunday). One click opt in here!*

🏗️ Lego sets made easy. Building a lego set with the kids but lost the instructions? Don’t worry, here is how to build thousands of sets.

🛖 Increase your home’s value. We found this article helpful on 8 things you can do to increase your home’s value. Not everything requires you to spend money.

🥤 Check what the kids are drinking. The Senate is calling on the FDA to investigate the energy drink PRIME saying one drink has the equivalent caffeine amount to 6 coke cans. Yikes.

✈️ Remote work, real advice. Remote Source is the #1 source of content for remote workers in the US. Learn about the latest macro trends, management best practices, new product reviews, and more. Work Remote, Live Free . Subscribe here!*

🪧 Get the latest marketing trends. Marketing Letter is designed for entrepreneurs, marketers, or anyone who wants to keep up with the latest trends. Sign up here!*

*this is a sponsored post

🗓️ The Week Ahead

Week of July 17th

Earnings season began this past week, and next week it will start to pick up with 65 reports. Just looking at the headlines of major companies can help give you a sense of if what we say above continues to hold true.

July 19th

We will get lots of housing data this week. Today we will get “housing starts” data for June which will tell us the number of new residential projects started in the month. We will also get an official number for how many existing homes (single family, co-op, and condo) were sold in June on July 20th. After this week should walk away knowing a lot more about the housing sector.

July 19th

On a lighter note, today is also Global Give Your Kids A Hug Day! The might resist the older they get but today you have a perfect excuse to try.

🍨 Dessert

This Week’s Deals For Families

Here are this week’s recs to help your family save and spend smarter*

🔥 Nordstrom’s long awaited Anniversary Sale is upon us (July 17-August 6th). Here is a list of the best buys.

💻 Microsoft kicked off its back to school sale on July 10th offering deals on computers, games, and accessories.

💰 For our small business owners or parents with side gigs, Shopify just added a native Buy now, pay later (BNPL) option called Shop Pay Installments Premium, allowing users to split their purchases into equal monthly payments.

*we aim to always keep this newsletter free. If you buy something through our listed deals we may earn a small commission, at no added charge to you, in order to help us keep the lights on

Dinner Discussion ❓

Answer: Vanguard Group is the largest shareholder of Apple, owning about 1.4 billion shares or just over 8% of the company as of their latest fillings. They own this stock largely through various funds they offer to clients, and because of their large ownership they can have a large impact on company decisions.